New underlying technological changes are driving the transformation of the chip industry, and the rapid development of smart cars has quietly changed the business model and operation model of the automotive chip industry. At the end of 2019, the sudden epidemic disrupted the original rhythm of many industries. While the outbreak of the virus is not the reason for the changes in the automotive chip industry, the chip shortage caused by the outbreak has made the chip industry unprecedented for governments, industry players and manufacturers. , and even the attention of end consumers. In this context, OEM manufacturers and chip companies are particularly keen on capability transformation, especially local companies. As soldiers approach the city, the autonomous control of autonomous chips so that there is enough food and weeds is a strategic issue that every business will face in the future.

The first part of the overview - the underlying new technology promotes global chip transformation, and the demand for subdivisions is strong

1.1 Technological iterations drive the rapid development of the chip industry

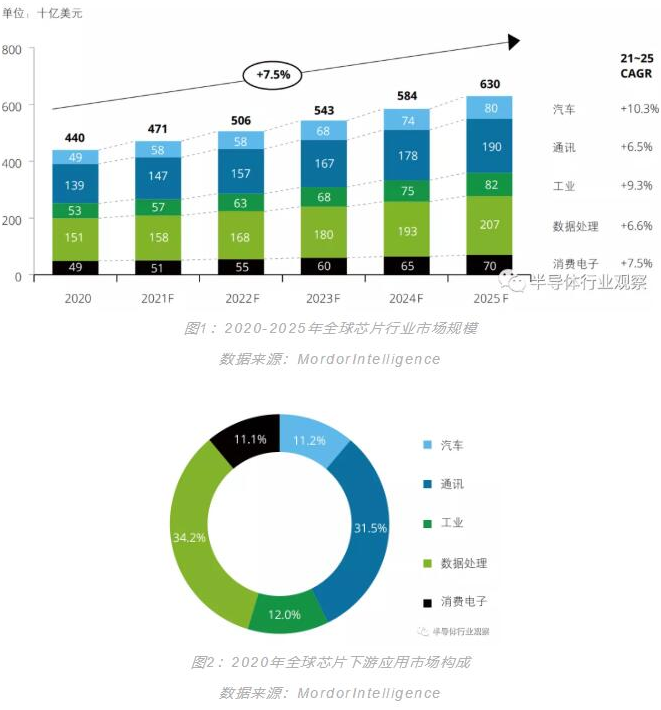

The continuous maturity of underlying technologies such as 5G and the Internet of Things will drive the continuous development of electrification and intelligence in the downstream field, thereby continuing to promote the steady growth of global demand for the chip industry. It is estimated that by 2025, the global chip industry market size will reach 630 billion US dollars. From the perspective of vertical segmentation, with the advancement of technology, industries such as automotive, industrial, communications and consumer electronics will usher in industry transformation, thereby increasing the total demand for chips. Among them, automobiles will become the main engine for the growth of the chip industry. . Data shows that in the next five years, the compound growth rate of automotive chips will be around 10%, ranking first in growth rate.

1.2 Black swan events restrict the release of supply-side capacity

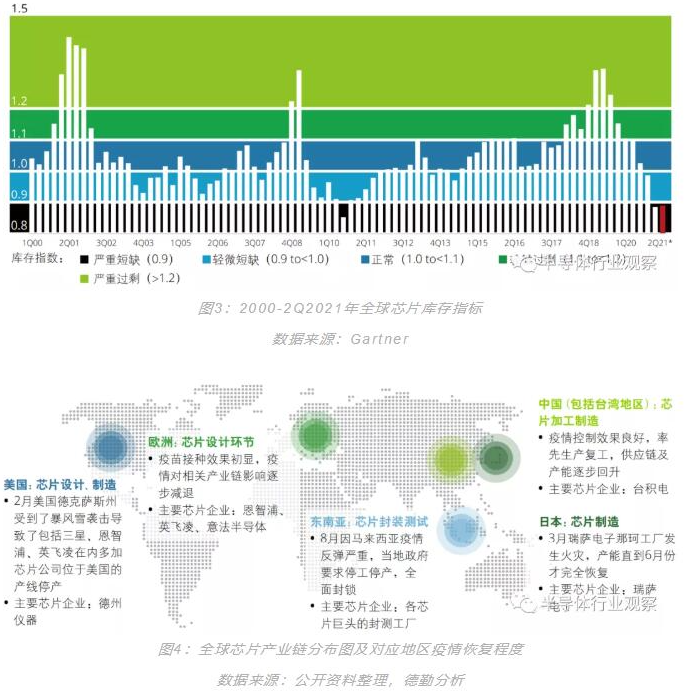

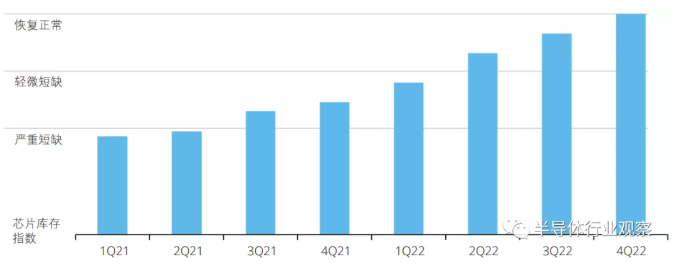

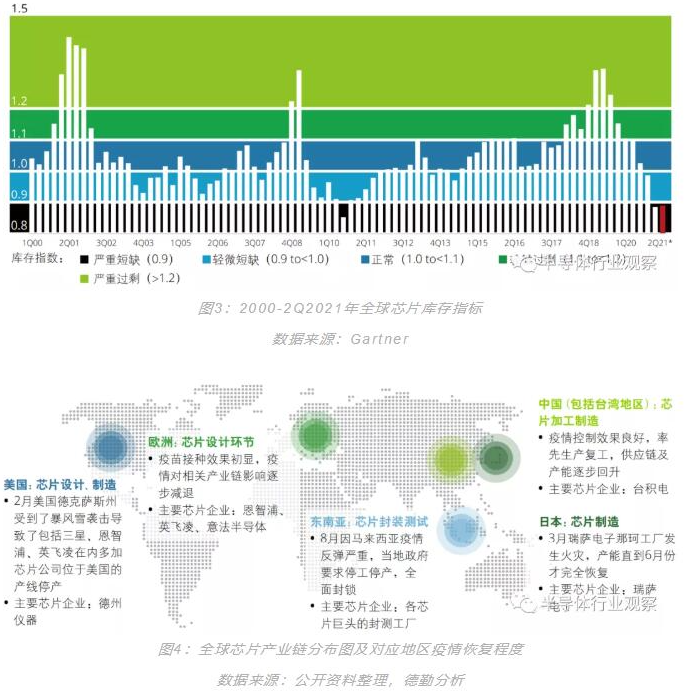

The global chip industry is highly cyclical. According to the global chip inventory index, in the second quarter of 2021, the global chip inventory index is below 0.9, and the global market is in a period of severe shortage of chips.

The chip industry chain covers chip design, manufacturing, packaging and testing, and each link is mainly distributed in different countries and regions. Upstream chip design companies are mainly concentrated in Europe and the United States, intermediate manufacturing companies are mainly concentrated in Japan and [敏感词], and downstream packaging and testing companies are mainly concentrated in Southeast Asia. Since 2020, the COVID-19 epidemic has swept the world, forcing factories of upstream and downstream enterprises in the industrial chain to suspend production. Although the fight against the epidemic is gradually stabilizing and countries and regions have resumed work and production in an orderly manner, the supply-side production capacity is limited due to the different levels of epidemic recovery in countries and regions.

In addition to the impact of the epidemic, natural disasters in some countries and regions have further restricted the release of production capacity on the supply side. The fire and earthquake severely affected the production capacity of Japanese automotive-grade chip supplier Renesas Electronics. Global chip supply continues to deteriorate as massive power outages triggered by Blizzard in Texas have halted production at Samsung, Texas Instruments and NXP.

1.3 Epidemic Stimulates Downstream Market Demand

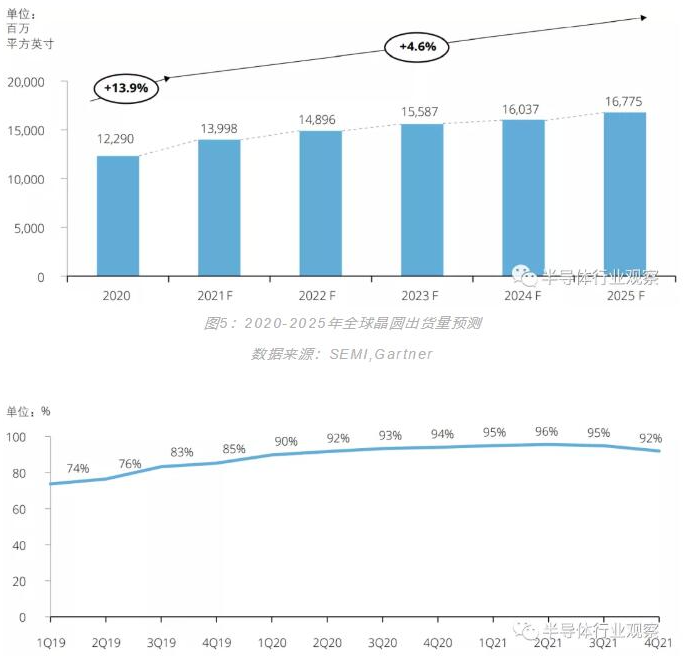

Under the influence of the epidemic, telecommuting has driven the demand for electronic devices such as smart mobile terminals, computers, tablets, and connected devices. During 2020, global silicon wafer shipments increased by 13.9% compared with 2019, and shipments reached a record high. Driven by continuous downstream demand, as of the third quarter of 2021, the capacity utilization rate of global wafer fabs has reached 95%, tending to peak capacity, with limited capacity for expansion in the short term.

Figure 6: Global Wafer Capacity Utilization by Quarter 2019-2021

The second part of Vipassana - the automotive industry welcomes "core" opportunities, but the shortage will continue in the short term

2.1 New energy vehicles continue to increase in volume, and automotive chips set sail

2.1.1 The development of electric intelligence drives the increase in the demand for automotive chips

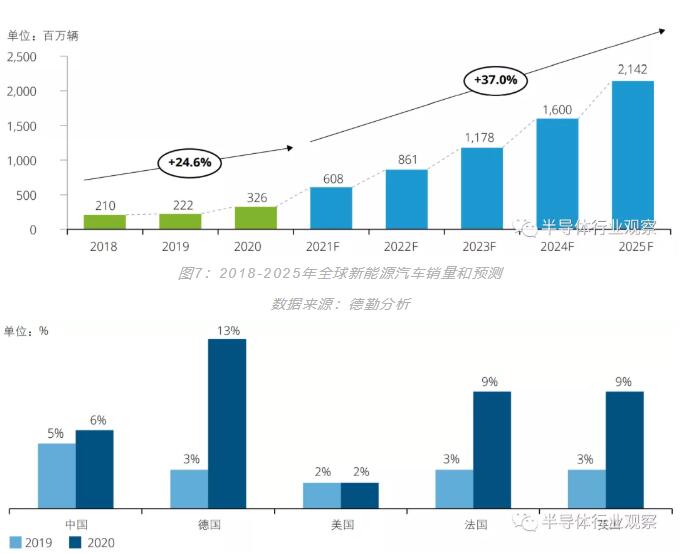

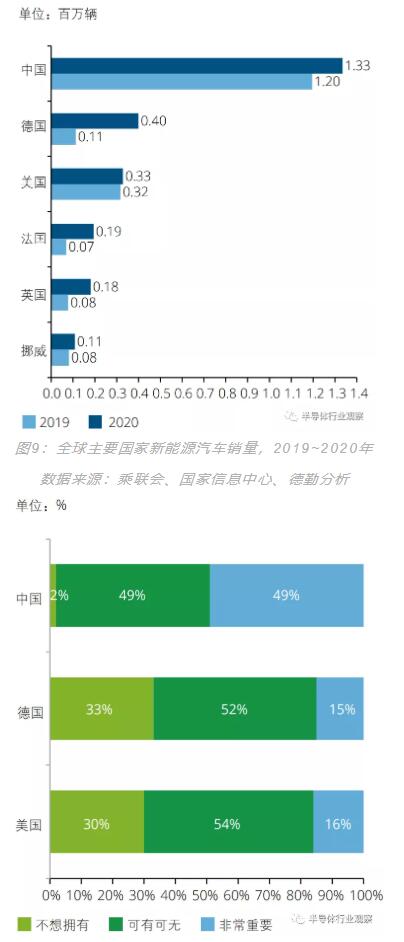

With the continuous advancement of the new four modernizations of automobiles, the global new energy vehicle market will usher in rapid growth, and the penetration rate of new energy vehicles in various countries will continue to increase.

Data show that it is expected that by 2025, the global sales of new energy vehicles will exceed 21 million, with a five-year compound growth rate of about 37%. In addition, the epidemic has not stopped the electrification and intelligence of the global automobile industry. Based on different development goals, the penetration rate of new energy vehicles in various countries continues to increase.

Figure 8: The penetration rate of new energy vehicles in major countries in the world in 2019-2020

Data source: Deloitte analysis

Focusing on China, as the world's largest new energy vehicle market, the number of new energy vehicles ranks first and consumers have the highest acceptance of the level of vehicle intelligence. In 2020, a consumer survey compared the acceptance of autonomous driving among consumers in Germany, the United States and China. According to the data, about 50% of Chinese consumers believe that autonomous driving is very important. The ratio is much higher than that of the United States and Germany. Conversely, only 2 percent of Chinese consumers said they “don’t want to have” self-driving features, while about 30 percent of U.S. and German consumers said the same. This means that China will become the most important market for electric and intelligent vehicles.

Figure 10: Consumer Importance of Fully Autonomous Driving Survey Data, 2020

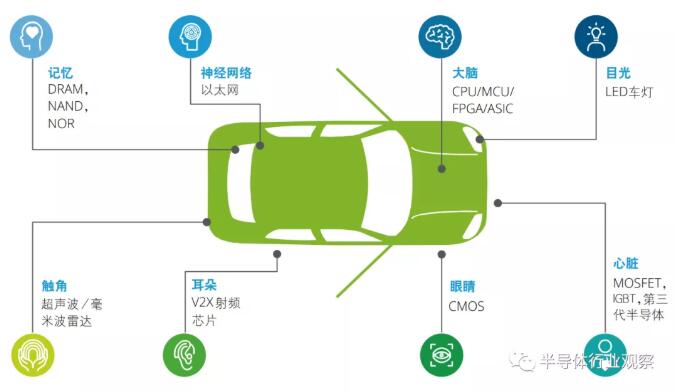

Intelligence has become Consumers are the core indicators for judging the attractiveness of new energy vehicles. With the further improvement of the level of electrification and intelligence, the importance of chips to automobiles is self-evident. At the perception level, multi-sensor fusion on the vehicle includes data collection of the surrounding environment through radar systems (lidar, millimeter-wave radar, and ultrasonic radar) and vision systems (cameras). At the decision-making level, the data is processed through the on-board computing platform and appropriate algorithms to make optimal decisions. Finally, the execution module converts the decision-making signals into vehicle behaviors. At the control execution level, it mainly includes the motion control and human-computer interaction of the vehicle, and determines the control signals of each actuator such as motor, accelerator, and brake.

Figure 11: The main application of the chip in the car

Data source: Deloitte analysis

-

The chip is the "brain" of the smart car. GPUs, FPGAs, and ASICs have their own strengths in the field of autonomous driving AI computing. The CPU in the traditional sense is usually the control center on the chip. Therefore, for AI high-performance computing, people usually use GPU/FPGA/ASIC for enhancement.

-

Power chips are the "heart" of smart cars. Whether it is in the engine, transmission control and braking in the drive system, or steering control, power chips are inseparable.

-

Camera CMOS is the "eye" of a smart car. CMOS image sensors and CCDs (charge-coupled components) have a common historical origin, but the price of CMOS is 15%-25% lower than that of CCDs. At the same time, CMOS chips can be integrated with other silicon-based components to reduce system costs. In terms of quantity, about 18 cameras are needed for assisted driving above L3, such as reversing rear view, surround view, forward view, and turning blind spot.

-

The RF receiver is the "ear" of the smart car. Radio frequency devices are important components of wireless communication. Radio frequency is an electromagnetic frequency that can be radiated into space, and the frequency range is between 300KHz and 300GHz. A radio frequency chip refers to a chip that can convert radio frequency signals to digital signals, including power amplifier PA, filter, low noise amplifier LNA, antenna switch, duplexer, tuner, etc. In the future, the radio frequency chip will help the development of C-V2X technology like the ear of the car, and organically link the transportation participation elements such as "people-vehicle-road-cloud", make up for the lack of bicycle intelligence, and promote the development of collaborative application services. .

-

Ultrasonic/millimeter wave radar is the "cane" of smart cars. Smart cars obtain a lot of data through sensors, and L5-level cars will carry more than 20 sensors. Vehicle radar mainly includes ultrasonic radar, millimeter wave radar and lidar. Among them, China's ultrasonic radar has relatively mature development, and the technical barriers are not high; millimeter-wave radar has high technical barriers and is an important sensor for smart cars, and is currently in a stage of rapid development; lidar has high technical barriers and is a high-level autonomous driving. It is an important sensor, but it is currently expensive, difficult to pass, and difficult to land.

-

Memory chips are the "memory" of smart cars. The demand for memory in the smart car industry is increasing day by day. In the post-mobile computing era, automotive storage will become an important emerging growth point in memory chips and a force that determines the market structure. DRAM, Flash, and NAND will be widely used in various fields of smart cars in the future. In addition, as cloud and edge computing will shine in the field of smart cars, and L4/L5 autonomous vehicles will develop complex network data and apply advanced data compression technology, the number of local storage will stabilize in the future, and may even decline. .

-

Automotive panels show a multi-screen trend. At present, in-vehicle display devices mainly include central control display and instrument display. In addition, intelligent cockpit instrument display, windshield composite head-up display, virtual electronic rearview mirror display, and rear-seat entertainment display have gradually become the development of intelligent vehicles. new demand directions.

-

LED has been fully popularized in the lighting field of smart cars. In terms of lighting brightness and illumination distance, LED has achieved a height that was unattainable by halogen lamps in the past, and can perform functions such as corner assistance (follow-up steering), speed adjustment, and distance warning. With the development of LED volume and technology, its intelligence has begun to be vigorously developed, and then strides forward in the direction of high brightness, intelligence and coolness.

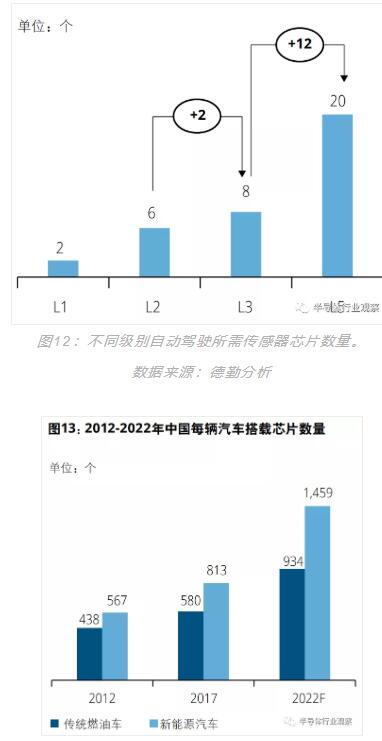

2.1.2 The trend of automotive intelligence drives the value of bicycle chips

Compared with traditional fuel vehicles, the number of chips used in new energy bicycles is gradually increasing. Taking autonomous driving technology as an example, the higher the level of autonomous driving, the more sensors are required. The L3 level autonomous driving is equipped with an average of 8 sensor chips, while the number of sensor chips required for L5 level autonomous driving increases to 20. In the same way, the amount of information that the vehicle needs to process and store is also positively related to the maturity of autonomous driving technology, which further increases the capacity of control chips and storage chips. According to statistics, by 2022, the average number of chips in new energy vehicles will be about 1,459, which is gradually distanced from the number of chips in traditional fuel vehicles.

Figure 13: Number of chips per vehicle in China, 2012-2022

Data source: Deloitte analysis

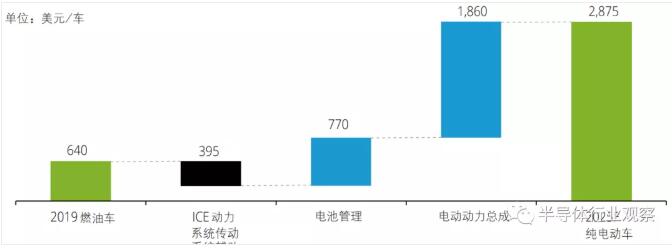

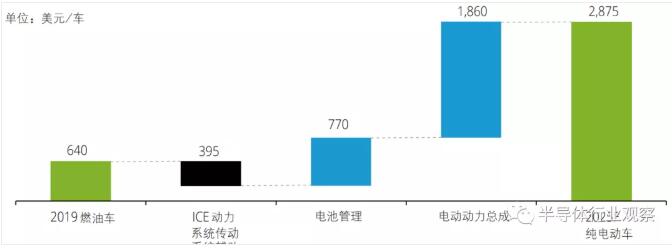

In addition, new energy vehicles that use the power system as a power source have higher requirements for power management and power conversion of electronic components, which increases the value of automotive chips. As autonomous driving technology matures, the price of chips on bicycles will also be higher. According to statistics, by 2025, the BOM (Bill of Materials) value of automotive electronic components will increase significantly, mainly due to the demand for electronic components (such as inverters, power Assembly domain controller DCU, various sensors, etc.).

Figure 14: BOM improvement of electronic components brought about by vehicle electrification

Data source: Deloitte analysis

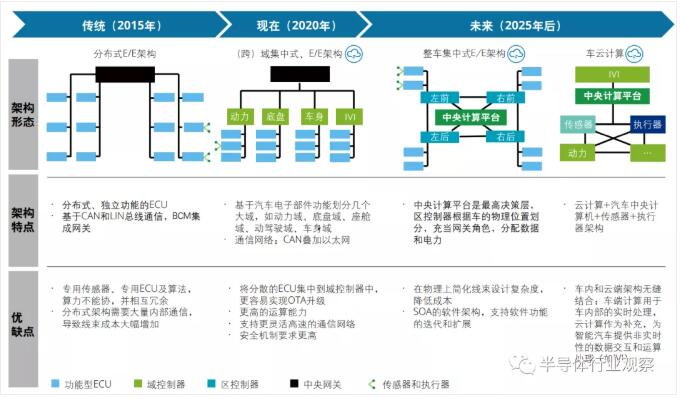

2.1.3 The electrification architecture of automotive electronics is becoming centralized, driving a structural change in chip performance

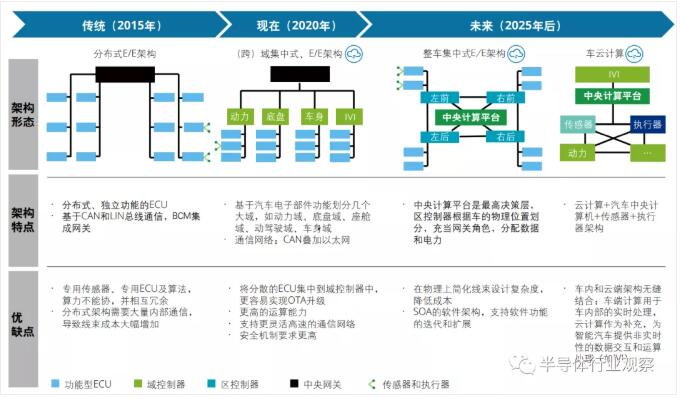

With the improvement of consumer demand for automobile economy, safety, comfort, entertainment, etc. in recent years, the distributed electronic and electrical architecture can no longer meet the demand for higher on-board computing power in the future. Not only that, electric intelligence has further promoted the number of electronic controllers. With the increase in the number of ECUs and sensors in the car, the cost and wiring difficulty of the vehicle wiring harness have also increased significantly. Therefore, whether it is for the deployment of more powerful computing power, higher signal transmission efficiency, or for the consideration of body weight reduction and cost control, the hardware architecture of automotive electronics and electrical appliances is required to change from traditional distributed to "centralized, light-weight" A change in the direction of streamlining and scalability”.

Figure 15: Roadmap for the evolution of the automotive electrification architecture

Data source: Deloitte analysis

2.2 The "chip shortage" continues to spread, and it is difficult to improve chips in the short term

Compared with the overall situation of the chip industry, the shortage of automotive chips is particularly prominent. According to the forecast of AFS, the global automobile production will be reduced by 8.107 million units in 2021, resulting in a total economic loss of 210 billion US dollars, and the Chinese market loss is expected to be about 26 billion US dollars. During the epidemic, demand for Misjudgment is the biggest cause of short-term automotive chip shortages. Affected by the COVID-19 outbreak, in early 2020, automakers lowered their forecasts for new vehicle demand, thus reducing orders for related parts.

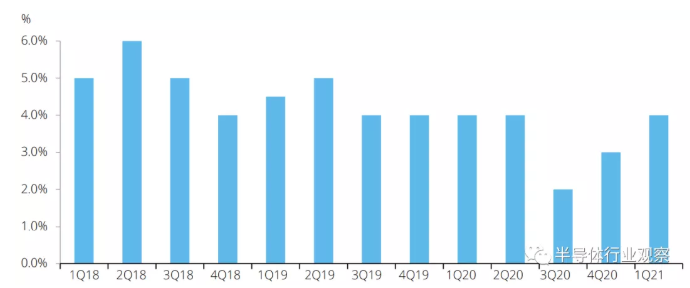

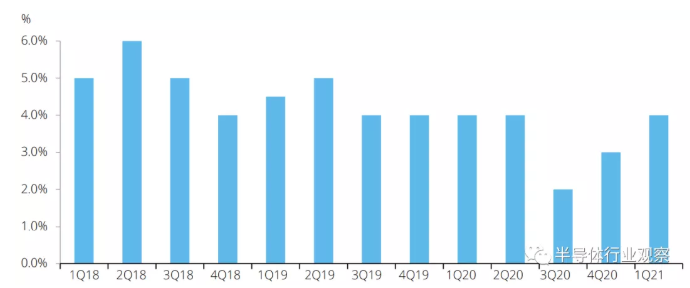

Figure 16: 1Q18–4Q20 [敏感词]’s revenue share of automobiles

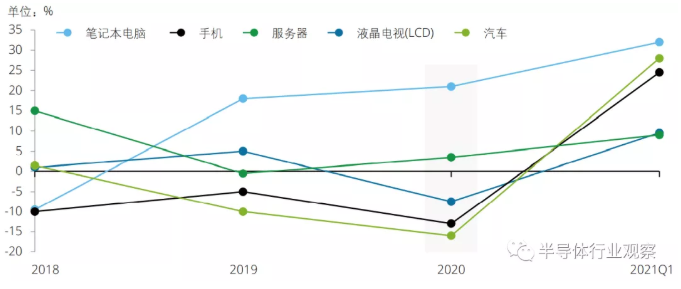

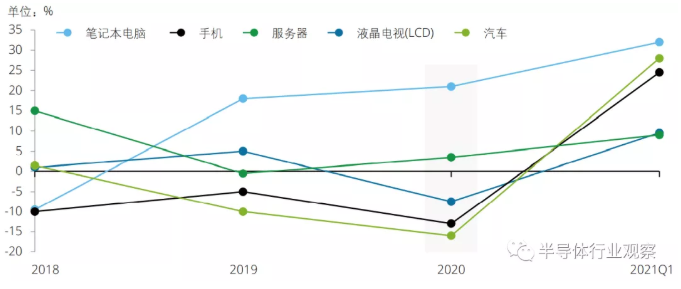

During the same period, the epidemic has stimulated demand for consumer electronics products, and almost all of the chip orders lowered by OEMs have been absorbed by consumer electronics demand. Take the first quarter of 2020 as an example, the global shipments of notebook computers, TVs, mobile phones, automobiles, servers, etc. have increased significantly, and notebook computer shipments have increased by more than 35%, facing the surge in consumer demand , almost all of the chip order production capacity lowered by OEMs has been transferred to consumer electronics production demand, resulting in vehicle shipments falling to the bottom.

Figure 17: 2021 Q1 global notebook/TV/mobile phone/automobile/server shipments

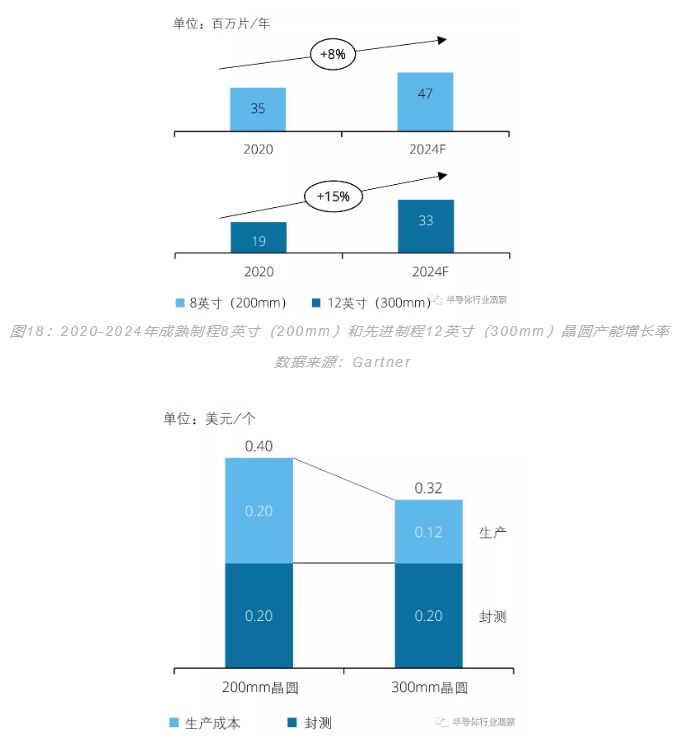

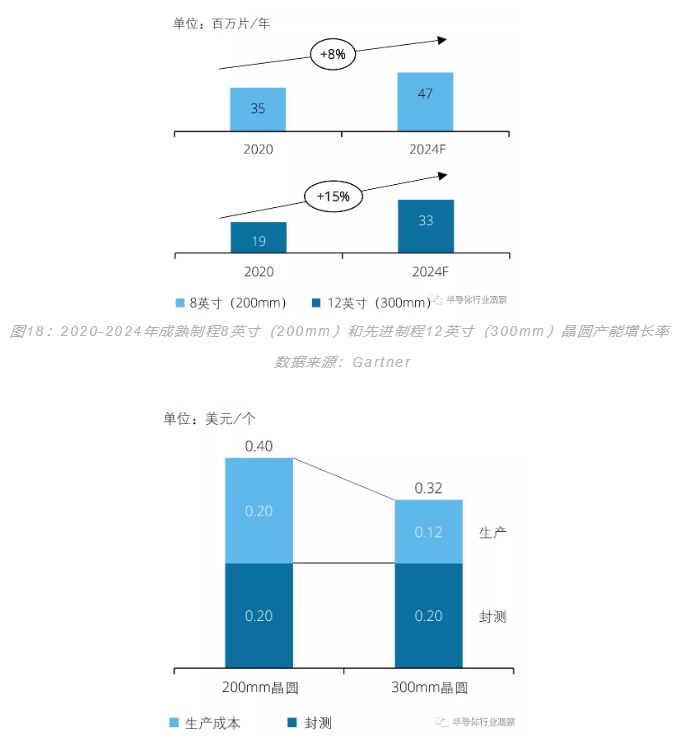

In addition, the relatively weak willingness of chip manufacturers to expand the production line of automobile chips is also one of the factors that caused the shortage of chips this time. For economical reasons, wafer manufacturers mainly expand the production capacity of more advanced 12-inch (300mm) wafers.

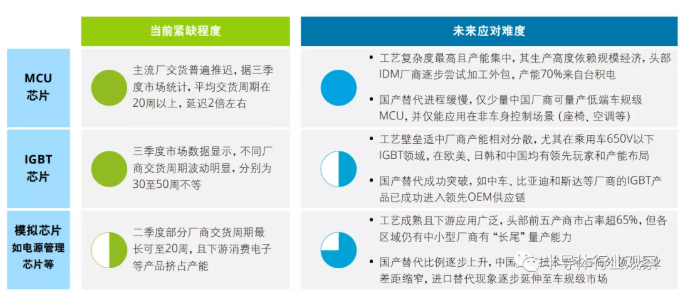

12 inches (300mm) Wafers are mainly used for the production of consumer electronic products such as computers, tablets and smartphones. In contrast, due to the high demand for safety and stability of automotive-grade chips, 8-inch (200mm) chips with mature processes are mainly used. Production line. Due to the higher production efficiency of the 300mm production line and a wider coverage of downstream applications, the supply-side capacity expansion is mainly based on 12-inch (300mm) capacity. Taking analog chip production as an example, using a 12-inch production line to produce analog chips saves 40% of production costs compared to an 8-inch production line, and for this reason, the gross profit margin can be increased by 8%. Therefore, it is predicted that the growth rate of 300mm capacity of global fabs in the future will be about twice the growth rate of 200mm capacity.

Figure 19: Production cost comparison of mature process 8 inches (200mm) and advanced process 12 inches (300mm) (analog chips) Data source: Texas Instruments

Figure 19: Production cost comparison of mature process 8 inches (200mm) and advanced process 12 inches (300mm) (analog chips) Data source: Texas Instruments

2.3 The long-term demand for chips is strong, and the trend of domestic substitution is clear

The main reason for this round of chip shortage is the mismatch between the market demand and supply of automotive chips under the epidemic environment. Therefore, the most effective solution is to expand supply-side production capacity. However, since the cycle from the establishment of chip production lines to large-scale production is about 1-2 years, this round of chip shortages will continue until the second quarter of 2022.

Figure 20: Forecast of global chip inventory indicators

In the short term, we have observed that many car companies, including traditional car companies, new car manufacturers and independent brands, have taken some short-term countermeasures to ease the production pressure caused by chip shortages. The main measures include temporary chip replacement and vehicle reduction. with delivery.

Temporary chip replacement. It is reported that a luxury imported brand OEM plans to adopt a temporary chip replacement solution for non-essential in-vehicle functions. After the chip supply is restored, it will be replaced and upgraded for consumers, and the necessary chips will be reserved for models with higher profits or lower emissions. models to complete the emission reduction task. This move reduces the impact of the shortage of automotive chips by adjusting the structure of chip usage while ensuring that the core safety functions of the car are not affected.

Similarly, leading electric vehicle OEMs with chip self-development capabilities are also actively taking action to deal with this problem. It is understood that due to their chip development capabilities, such OEMs are trying to rewrite the software to adapt to the alternatives of the available chips. Similar traditional head OEMs are also trying to reduce the use of shortage chips by redesigning auto parts to fit more chips available.

Reduced delivery of vehicles. In addition to exploring the possibility of chip replacement, many car companies have adopted the method of reduced allocation and delivery to ensure the normal operation of the car production line. Taking a new leading car maker as an example, in order to ensure the normal delivery of vehicles, the company has reduced the number of millimeter-wave radars on the recently delivered models, from the originally planned 5 millimeter-wave radars to 3, waiting for the required chips. After the supply is restored, supplementary installations are carried out for consumers. Similarly, many traditional international car companies have also adopted the method of reducing the allocation of chips to deal with the crisis of chip shortage, such as reducing the use of chips for non-essential components and reducing the configuration of vehicles.

At present, although various car companies have adopted different types of solutions, it is not a long-term solution. Whether it is a temporary alternative or a reduction in vehicle functions, it will further increase the research and development costs of car companies and reduce consumers' confidence in car purchases.

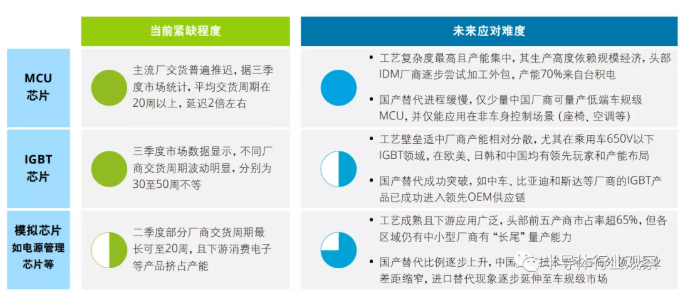

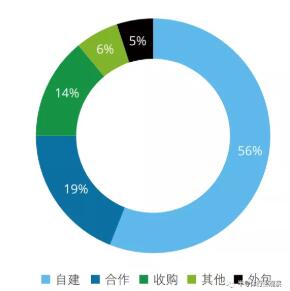

In the medium and long term, for different types of automotive chips, due to different technical barriers, the degree of shortage and future response measures will be different.

Figure 21: The shortage of each chip sub-category and the difficulty of alleviating the shortage

Data source: public data organization, Deloitte Analysis

Figure 21: The shortage of each chip sub-category and the difficulty of alleviating the shortage

Data source: public data organization, Deloitte Analysis

Microcontroller (MCU) chips are the most in short supply, and recovery is challenging. Automotive-grade MCU chips have a long R&D cycle, high supporting requirements, and great joint responsibility. It is difficult to see OEM manufacturers or chip companies making breakthroughs in the high-end automotive-grade MCU chip industry chain in the short term. The top five companies in the world are NXP, Infineon, Renesas Electronics, STMicroelectronics and Texas Instruments, with a total market share of more than 95%. In addition, about 70% of the world's automotive-grade MCU chips are manufactured by [敏感词], and domestic substitution is less feasible. Therefore, until the adjustment of [敏感词]'s production capacity is completed, such chips will remain in a state of shortage.

The shortage of power chips (IGBT) is expected to ease in the medium term. Due to the relatively mature production process of IGBT chips, automotive-grade IGBT chips have broken through technical barriers, and some of them have been replaced by domestic products, and domestic production capacity can meet short-term demand gaps.

The shortage of analog chips for power management is gradually easing. Due to the relatively mature technology of this type of chip, in addition to the large number of leading companies occupying the market, small and medium-sized manufacturers in various regions including China have achieved technological catch-up and gradually entered the regional supply chain, and the domestic substitution effect has emerged.

The third part of the planning article - reshaping the value chain of the automotive industry and building a new ecology of prosperity for the industry

3.1 Policies help the construction of the industry and make up for the shortcomings of the industry

The Chinese government spares no effort to support the chip industry. Throughout the evolution of the industry, the role of the government and related departments in the automotive chip industry has gradually deepened. In conclusion, the government and related departments have actively played the following key roles:

One is the policy facilitator. Through the formulation of economic means such as tax relief, support the development of enterprises in the chip industry chain. For example: tariff-free policy for imported equipment, materials, and spare parts; the policy of “two exemptions and three halvings” for equipment, materials, packaging and testing companies, etc. At the same time, it also supports and cultivates related fields in education, scientific research, development, financing, application, etc. Talent

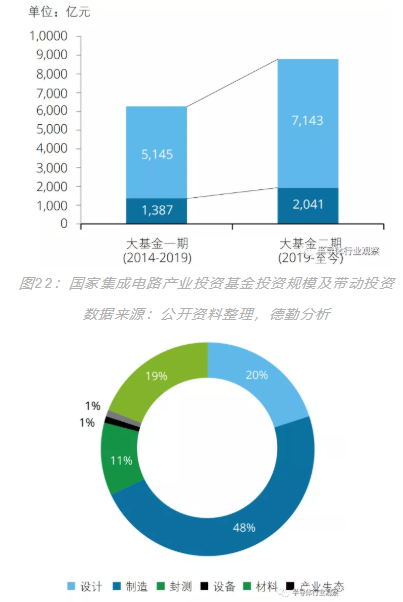

The second is the cultivator of local invisible champions . Since 2014, the Ministry of Finance, the Ministry of Industry and Information Technology, the China Development Bank, etc. have jointly initiated the national industrial fund "National Integrated Circuit Industry Investment Fund", which focuses on investing in leading enterprises in the domestic chip industry chain and strongly supports my country The construction of independent controllable integrated circuit supply chain.

Figure 23: National Integrated Circuit Industry Investment Fund (Phase I) Investment Category (2019)

Data source: public data organization< /span>

The third is the industry development strategy makers. During the two sessions in 2021, the central government will formulate strategies to increase the localization rate of automotive-grade chips. At the meeting, the strategic guidelines of "improving the localization rate of automotive-grade chips" and "developing automotive-grade chips" were proposed in two steps: the first step is jointly promoted by OEMs and system suppliers, supporting key chip companies and helping chips The company first solves the problem of localization of automotive-grade chips with low technical thresholds, and improves the capability of its automotive-grade localization system. The second step is to promote chip suppliers to form an endogenous power mechanism for chip suppliers to solve problems with high technical thresholds. Localization of automotive-grade chips.

The fourth is resource integrator and industry standard setter. The automotive industry's chip certification standards are strict, and the demand for security is extremely high. However, the current domestic automotive chip field lacks a sound standard system and testing and certification platform, and the process quality of automotive-grade chips lacks systematic accumulation. These phenomena hinder the long-term investment willingness of automotive chip companies. In 2020, the China Automotive Chip Industry Innovation Alliance was established. The alliance cross-border integration of the two industries of automobiles and chips, jointly established with the upstream and downstream of the industrial chain, to form a transparent, consistent and open industry certification standard, and to open up the upstream and downstream resources of the industrial chain to jointly promote the industry. In the same year, the Handbook of Supply and Demand for Automotive Chips issued by the Electronic Information Bureau of the Ministry of Industry and Information Technology proposed to establish a supply and demand platform for automotive chips, integrate upstream and downstream supply and demand resources in the industry, and solve the imbalance between supply and demand caused by information asymmetry through the connection of information and resources.

3.2 Auto companies "show their magical powers" to ensure supply chain security and control

Current domestic OEMs, Chip companies first break through the technical barriers of automotive-grade IGBT chips, and then make efforts to more complex and stricter technical requirements and industry-related supporting standards for automotive-grade MCU chips. From the perspective of layout mode, it mainly includes two modes: the independent mode, represented by BYD; the interlocking mode based on equity cooperation, represented by Toyota Group and SAIC Group.

Ensure supply chain security. BYD started with the battery business. Since the IGBT is the core component of the three-electrical system, the company established the key strategy of building its own IGBT supply chain at an early stage. Up to now, BYD has a market share of about 20% in China's IGBT market, second only to Infineon, the world's leading IGBT company. In addition to ensuring the stable supply of its own IGBT chips, BYD also has the ability to export vehicle-grade IGBT chips to the outside world. Some domestic vehicle manufacturers are also major customers of BYD IGBT chips.

Facilitate cost leadership strategies. The cost of IGBT chips in the three power system is high. Benefiting from the independent and controllable supply, the cost of BYD IGBT has an absolute competitive advantage compared with competing products, which is only 1/3 of that of competing products. In addition, the integrated design starting from the components is realized in the process of the overall scheme design and selection of the battery, which improves the production efficiency and reduces the cost. Not only that, due to the independent and controllable production process, the component specifications and standards are unified, which supports BYD's platform strategy and further reduces the cost of vehicle manufacturing. On the whole, the independent and controllable chip supply chain has helped BYD gain cost advantages and enhance product competitiveness.

Support future business development. In addition, BYD also plans to develop the foundry business in the future, and the core competitiveness of the foundry model also lies in the cost advantage. Due to its IGBT full industry chain capabilities and its manufacturing experience in the field of batteries and vehicle production, BYD will externalize its accumulated industry experience to further enhance its influence in the automotive industry.

Cross Shareholding Model - Toyota Group

Toyota Group invests in automotive-grade chip giant Rui SA Electronics ensures the security and stability of chip supply. Cross-shareholding is Toyota's customary means of deep binding with core parts suppliers. As cars turn to electric vehicles and autonomous driving, chips and software play an increasingly important role in cars. Here In the context, the Toyota Group indirectly holds a 4.5% stake in Renesas Electronics (2019) through its core parts supplier Denso (DENSO) to deepen the partnership. Due to the deep binding relationship, the impact of Toyota in this round of automotive chip shortages is less than that of other companies. Compared with a pure purchasing relationship, the cross-shareholding model helps OEMs gain priority in special times.

Joint Venture Model - SAIC Infineon

Deep binding core supplier, make sure IGBT Supply is stable. For SAIC, the establishment of the joint venture not only reduces the procurement cost of IGBTs, but also ensures the stable supply of IGBT chips. On the other hand, SAIC also uses the resources of the joint venture company to cultivate local teams and reserve automotive-grade chip talents.

Quickly capture new market opportunities, seize localized demand, and expand industry influence. China is by far the largest electric vehicle market in the world. The establishment of a joint venture will help Infineon to stabilize the cooperative relationship with Chinese automakers, and quickly seize local customer needs and market opportunities with the help of local resources of partners , Quickly form practical application cases, so as to truly open up the Chinese market. We also see that in the future, international leading companies will take more and more localization measures in order to quickly respond to the needs of the Chinese market on the production side, sales side and server side.

3.3 Build a new model of ecological cooperation and promote the high-quality development of automotive chips

The construction of the ecosystem depends on the transformation of the core capabilities of enterprises. In conclusion, enterprises should focus on: business model transformation, improvement of merger and acquisition integration capabilities, empowerment of digital tools, and transformation of talent awareness and capabilities.

3.3.1 Business Model Transformation: Innovative ways to innovate products and improve the fit between products and consumers

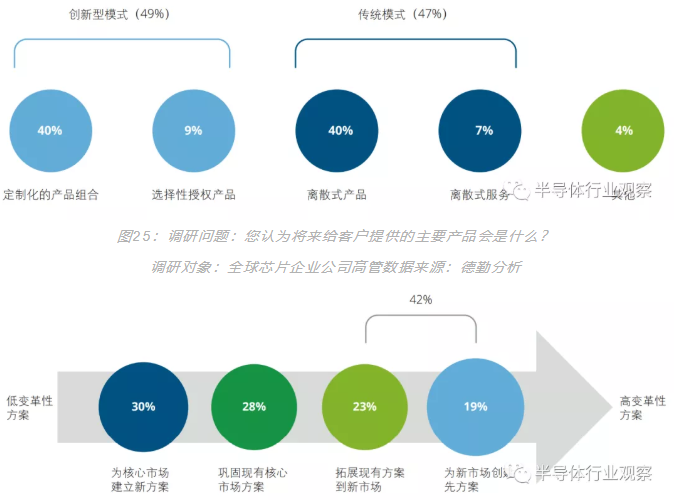

OEMs, chip companies and hardware manufacturing companies hope to co-create solutions in the future and transform their business models from a "transaction-based" revenue model to a "continuous service-based" business model.

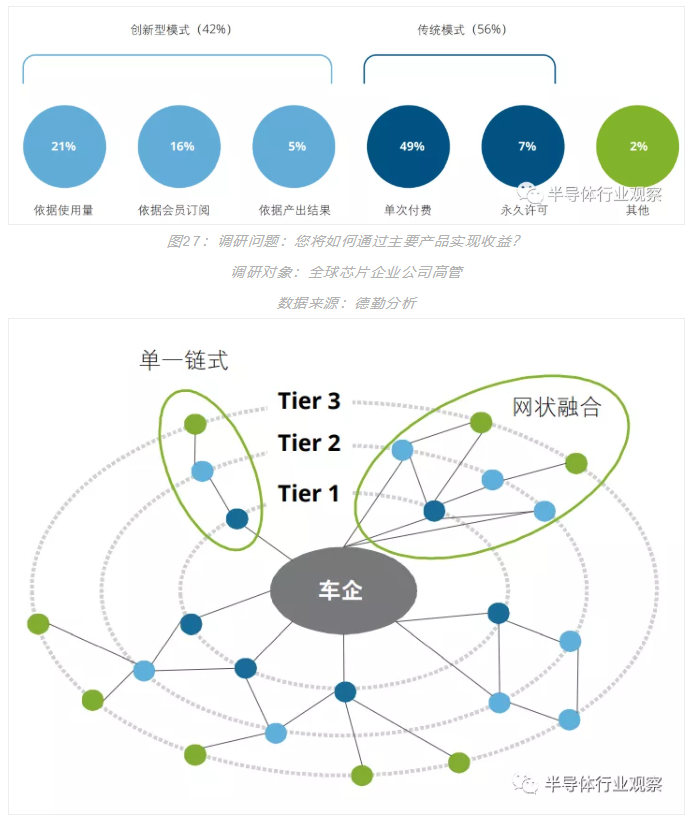

Based on Deloitte's leading global chip According to the corporate survey results, 42% of the surveyed corporate executives hope to penetrate into new markets and shape new business models by co-creating scenario-based solutions with vertical industry giants or software companies. The change behind this means that the mode of product development, sales, and market entry of the above-mentioned enterprises will be transformed. In addition to providing existing core products, many chip companies will expand their product lines to meet the customized needs of OEM manufacturers and end consumers.

19% of global chip leaders believe that new solutions should be developed for new markets. Nearly 50% of chip companies believe that business models such as customized product portfolios, scenario-based integrated solutions, and selective licensing fees will be as important as the existing traditional and independent product models.

Figure 26: Research question: Which approach best describes how you will address your strategic target market in relation to your transformation strategy?

Research objects: Global Chip Company Executive

Data source: Deloitte Analysis

Nearly 42% of chips are considered by the surveyed companies , it is necessary to establish a subscription and charge-by-use model. These concepts are not only the cognition of chip design companies, but also include chip production and manufacturing companies. This philosophy is similar to the changes that have taken place in the software industry in 10-15 years. In the past 20 years, it is this concept that has driven the transformation of the software industry and created many business models with high growth and high value that can generate sustainable income. We believe this trend will also permeate the chip industry and the OEM field.

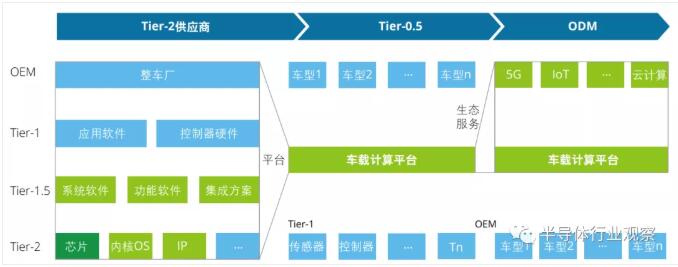

Figure 28: The supply chain structure of the automotive industry has changed from a single chain to a mesh integration

In this context, OEMs and chips The corporate cooperation model has evolved from "linear" to "mesh":Taking AI chip suppliers as an example, judging from the development trend in recent years, algorithm companies and chip companies that were originally in Tier-2 positions have strengthened their Software and hardware collaborative development capabilities, realize the comprehensive integration of hardware resources, system software, and functional software, and are compatible with the diverse needs of the upstream and downstream of the industry chain, and gradually jump from a second-level sub-supplier to a first-level or even 0.5-level supplier of OEMs , occupy the core in the development period of intelligent network status.

Figure 29: The changing roles of AI chip companies in the smart car industry chain

The above changes, OEM And the R&D, supply chain, and production mode of chip companies have undergone major changes accordingly. In the R&D process, OEM manufacturers bring in partners in advance to jointly formulate scenario-based solutions and design products; in the supply chain and production processes, mass production according to customized solutions has higher overall process, quality management, and standardization. challenge;

3.3.2 Through ecological cooperation and mergers/ Ability to acquire through joint ventures and other methods

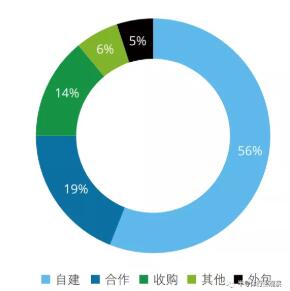

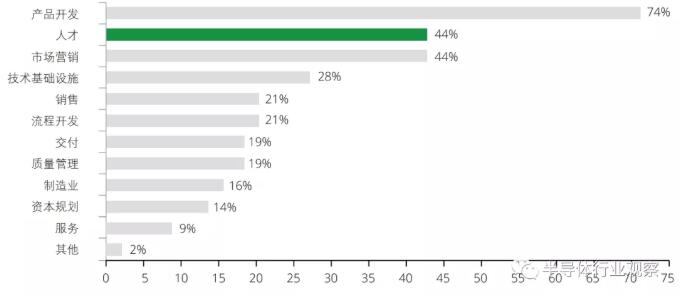

Based on Deloitte global chip leader As a result of enterprise research, in addition to self-construction capabilities, more and more enterprise management recognizes that ecological construction and mergers and acquisitions integration will be the key capabilities for enterprise transformation.

It is worth noting that building a cooperative ecosystem requires systematic coordination. Enterprises need to clarify their own core capabilities, and partners to clarify the cooperation model and the boundary between the two parties; establish a partner cooperation mechanism covering the full cooperation life cycle from partner recruitment, co-creation, co-marketing, and co-delivery. At the same time, some of the world's leading high-tech companies have established exclusive ecological cooperation organizations, which are responsible for partner docking and management, technology and solution evangelism, business opportunity follow-up, cooperation project tracking, joint marketing activity planning and implementation, and partner rights and assessments. System design and implementation, partner operation system design and implementation.

Figure 30: Deloitte Global Chip Leader Enterprise strategic transformation core competency acquisition path Survey question: How do you plan (or tend to) acquire the ability to support your transformation?

Survey object: executives of global chip companies

Data source: Deloitte Analysis

At the same time, corporate It is also necessary to quickly acquire capabilities in the short term through mergers and acquisitions, and through the establishment of joint ventures, OEM manufacturers and chip companies form long-term interlocking of interests. It is worth noting that the establishment of mergers and acquisitions and joint ventures is not an easy success. The two companies often fail due to incompatibility of strategic goals, unbalanced governance and interests, lack of integration experience, and differences in culture and communication. According to Deloitte's M&A and integration methodology and experience, companies should focus on 12 key success factors to promote the success of M&A, and at the same time, follow up on corresponding capacity building.

Figure 31: Key elements of Deloitte M&A/JV success

3.3.3 Build a digital engine and cultivate digital DNA

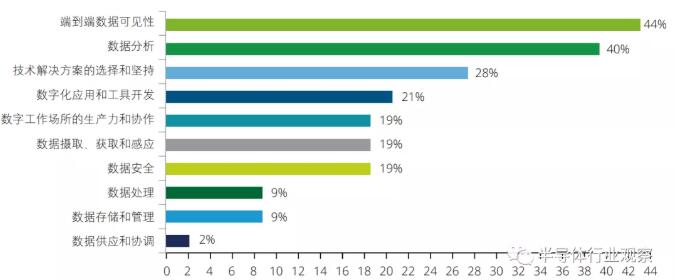

Future, with the car The degree of "new four modernizations" continues to deepen, and the two main lines of "user" and "intelligence" will become the core competitiveness of the industry in the future. In this context, it is very important to build the digital capabilities of enterprises. Therefore, car companies need to start building a data closed-loop system, forming a closed-loop system from data production, data processing, data use, and data return to support the iterative upgrade of future car companies’ business models and help the construction of the car company’s ecosystem. According to Deloitte research, end-to-end data visibility and data analysis are the most important core digital support capabilities for the organizational transformation of automotive and chip companies.

Figure 32: Digital DNA at the core of the most important organizational transformation

Research questions: Which core technologies are right for What matters most to your transformation? (select first 1-2)

Research object: global chip companies Executives

Data source: Deloitte analysis

3.3.4 Create a composite talent echelon under the new ecology

According to Deloitte Global Chip Globe According to the survey results of enterprises, enterprises believe that the most important industrial factor in product production is the transformation of human capacity. The demand for talents in automobile factories and industrial chains is gradually subdivided, and the demand for cross-industry compound talents will increase significantly. The following requirements are put forward for the company's future human resource management strategy: first, to provide a diversified capacity development platform for the existing system talents; second, to recruit cross-border talents and strengthen human resources; third, to establish organizational resources for specific talents , can not transfer fully decentralized resources to a certain degree of freedom, can not be due to the company's degree of freedom, the interweaving of administrative relations and the aggression caused by gambling; fourth, it must be a talent strategy, in the future, software capabilities will gradually become the main engine factory's For core combat capabilities, OEMs will become first-tier suppliers to interact and connect with second-tier manufacturing companies.

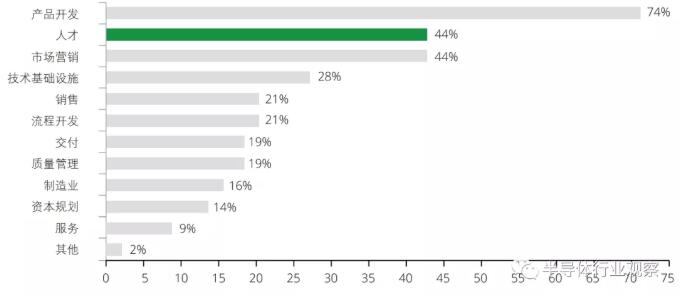

Figure 33: Deloitte Global Chip Leaders Survey on Core Elements of Strategic Transformation

Research Questions: Which Core Competencies Critical to your transformation strategy? (select first 1-3)

Data source: Deloitte Analysis

Behind this shortage of automotive chips reflects the fragility of the global automotive chip supply chain, and the autonomy and control of the automotive chip industry is becoming more and more important. In the future, with the continuous advancement of the "four modernizations" transformation of the automotive industry, the number and performance of chips will be significantly improved. It is foreseeable that increasing the localization rate of automotive-grade chips has become an important national strategy. Under the guidance and support of national policies for the local chip industry, national chip companies will usher in a period of rapid development opportunities. Facing all participants in the automotive industry chain, deepen cooperation and jointly respond to industry challenges and meet industry changes with a more open and diverse partnership.

Currently, the realization of autonomous and controllable automotive chips is a microcosm of my country's great journey from high growth to high quality. In the future, we will always be in a complex and changeable, hazy and uncertain environment. The boundaries of various industries will be broken and opened. Ecological cooperation and collaborative cooperation will be the long-term theme. All parties must join hands to build a new ecosystem and lead the wave of change.

Disclaimer: This article is reproduced from "Intelligent Connected Vehicle Network". This article only represents the author's personal views, not the views of Sacco and the industry. It is only for reprinting and sharing, and supports the protection of intellectual property rights. Please indicate the original source and author for reprinting. If there is any infringement, please contact us to delete it.