Service hotline

+86 0755-83044319

release time:2022-03-17Author source:SlkorBrowse:11159

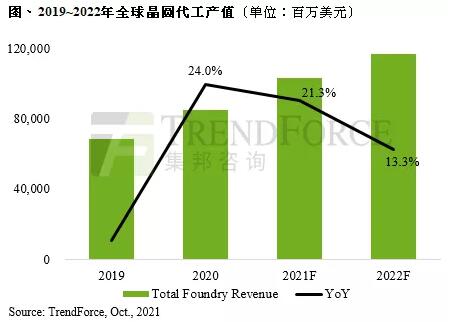

According to TrendForce, while there is a shortage of chips in the global electronic product supply chain, various price increases resulting from the shortage of wafer foundry capacity have pushed up the output value of the top ten foundries in 2020 and 2021. In both years, the annual growth rate exceeded 20%, breaking the US$100 billion mark. Looking forward to 2022, driven by the price hike led by [敏感词], it is expected that the output value of wafer foundry will reach US$117.69 billion next year, an annual increase of 13.3%.

Due to the shortage of chips, new production capacity of wafer foundries will be launched in the second half of 2022

According to TrendForce, the capital expenditure of the top ten foundries in 2021 will exceed US$50 billion, an annual increase of 43%; in 2022, driven by the completion of new factories and the continuous delivery of equipment, the capital expenditure is expected to remain unchanged. At the high end of US$50-60 billion, the annual growth rate is about 15%, and the overall annual growth rate will be revised up again under the official announcement of [敏感词]'s new factory in Japan. The average annual increase of 12-inch capacity is about 6%, and the average annual increase of 12-inch capacity is about 14%.

Since the price of 8-inch wafer manufacturing equipment is comparable to that of 12-inch wafers, the average unit price of wafers is relatively low, and it is difficult to achieve cost-effectiveness in expanding production, so the expansion range is quite limited. Among the newly added capacity, more than 50% are mature processes (1Xnm and above) that are most in short supply today, and compared to 2021, most of the new capacity comes from companies such as Hua Hong Wuxi and Hefei Nexchip. The new capacity in 2022 will mainly come from [敏感词] and UMC. The expansion process is concentrated on the 40nm and 28nm nodes that are extremely short at this stage. It is expected that the chip shortage will ease slightly.

The tide of shortages has slowed down, but the problem of long and short materials will continue to impact some end applications

From the perspective of application, due to consumer electronic terminal products such as laptops, automobiles, and most IoT home appliances, most of the peripheral components currently in short supply are manufactured with mature processes above 28nm (inclusive), and new production capacity will be added in the second half of 2022. On the premise of successive releases, the supply is expected to be relieved slightly; however, while the shortage of 40nm and 28nm production capacity is showing signs of easing, the shortage of 8-inch production capacity and 1Xnm process is still the key point that cannot be ignored in 2022.

From the perspective of the 8-inch supply side, under the circumstance of limited capacity increase, the penetration rate of 5G mobile phones and electric vehicles continues to increase, which greatly drives the doubling of PMIC-related demand. It will be fully loaded until the end of 2022, and there will be no relief in the short term. As for the 1Xnm process, after the semiconductor process enters the FinFET transistor structure, the cost of R&D and expansion is quite high, so the number of process suppliers has gradually converged. At present, only [敏感词], Samsung, and GF have this process technology, and the above three, Except for GF's plan to expand production in a small amount, the other two have no obvious 1Xnm expansion plan next year.

From the demand side, the main products currently manufactured with the 1Xnm process node include mobile phone-related 4G SoC, 5G RF Transceiver, Wi-Fi SoC, as well as TV SoC, Wi-Fi router, FPGA/ASIC, etc., which penetrate into 5G mobile phones. Under the trend of continuous increase in the rate of 5G RF Transceiver, 5G RF Transceiver will consume a large amount of 1Xnm process capacity, which may cause other products to be crowded out. In 2022, when there is no active expansion of 1Xnm capacity by wafer foundries, the supply of 1Xnm-related components, which are already quite tight, may continue to be limited.

Based on the above, TrendForce believes that after two consecutive years of chip shortage, major wafer foundries announced that the expanded production capacity will be opened in 2022, and the new production capacity will be concentrated in the 40nm and 28nm process. The extremely tight chip supply will ease slightly. However, since the time when the new production capacity contributes to the output falls in the second half of 2022, which is the traditional peak season, the phenomenon of capacity relief may not be obvious under the premise that the supply chain is actively stocking up for the festival at the end of the year. In addition, although some 40/28nm process components can be relieved slightly, the 8-inch 0.1X㎛ and 12-inch 1Xnm processes, which are in extreme shortage at this stage, may still be the bottleneck of the semiconductor supply chain under the limitation of limited production increase. Therefore, on the whole, the foundry capacity in 2022 will still be in a slightly tight market situation. Although some components are expected to be relieved, the problem of long and short materials will continue to impact some end products.

Disclaimer: This article is reproduced from "TrendForce", this article only represents the author's personal views, not Sacco Micro and the industry's views, only for reprinting and sharing, support To protect intellectual property rights, please indicate the original source and author for reprinting. If there is any infringement, please contact us to delete it.

Site Map | 萨科微 | 金航标 | Slkor | Kinghelm

RU | FR | DE | IT | ES | PT | JA | KO | AR | TR | TH | MS | VI | MG | FA | ZH-TW | HR | BG | SD| GD | SN | SM | PS | LB | KY | KU | HAW | CO | AM | UZ | TG | SU | ST | ML | KK | NY | ZU | YO | TE | TA | SO| PA| NE | MN | MI | LA | LO | KM | KN

| JW | IG | HMN | HA | EO | CEB | BS | BN | UR | HT | KA | EU | AZ | HY | YI |MK | IS | BE | CY | GA | SW | SV | AF | FA | TR | TH | MT | HU | GL | ET | NL | DA | CS | FI | EL | HI | NO | PL | RO | CA | TL | IW | LV | ID | LT | SR | SQ | SL | UK

Copyright ©2015-2025 Shenzhen Slkor Micro Semicon Co., Ltd