Service hotline

+86 0755-83044319

release time:2022-03-17Author source:SlkorBrowse:11630

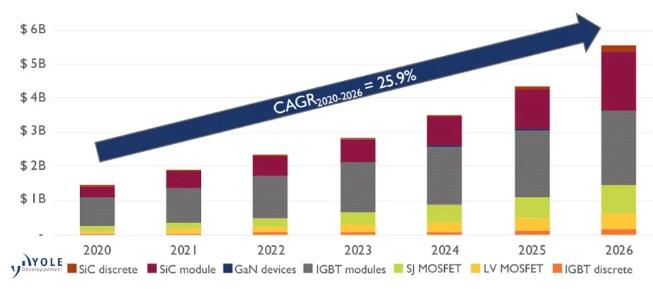

By 2026, the strict CO2 emission target will make the share of electric vehicles/hybrid vehicles (EVs/HEVs) in all passenger cars reach 38%, which means that various semiconductor technologies and power devices will gain a market opportunity of USD 5.6 billion. This is the judgment of Yole Dedevelopment, a market research company, in Power Electronics Technology of Electric Vehicles in 2021.

There are so many kinds of electric cars.

Whether it's EV or HEV, it's electric vehicle, or xEV. Its specific classification is as follows:

Mild Hybrid Electric Vehicle (MHEV): Vehicles using internal combustion engine (or thermal motor) and electric motor, usually using auxiliary ICE motor with power of 10-20kW, including 48V (mild hybrid) vehicles equipped with low-voltage batteries.

Hybrid electric vehicle (full HEV, strong HEV): a vehicle that uses internal combustion engine and electric motor. The electric motor is powered by a high-voltage battery, which can provide high power for the motor. The power range is 70-170kW, and the battery cannot be charged from the power grid. Its battery energy capacity is relatively low (about 2-5kWh), so the driving range in E mode is limited (several kilometers);

Plug-in Hybrid Electric Vehicle (PHEV): A vehicle that uses an internal combustion engine and an electric motor (like a full hybrid). The battery of PHEV can be charged from the power grid, so it contains an on-board charger and a charging plug. The capacity of the battery is greater than that of the full HEV, usually about 9kWh. If a two-way charger is used, the car can be used as a power source for V2G (vehicle to grid) and V2H (vehicle to home) applications.

Extended Range Electric Vehicle (EREV): It is a battery electric vehicle that includes an auxiliary power unit (APU) called "mileage extender". This small generator is usually an internal combustion engine (ICE), but a fuel cell can also be used. The generator charges the battery, which supplies power to the motor of the vehicle. This arrangement is called a series hybrid powertrain. The mileage extender is not suitable for daily use, and only applies to the case where the driver needs to extend the mileage of the vehicle to reach the next charging station.

Battery electric vehicle (all-electric vehicle, BEV): only the motor (without ICE motor), using a high-power, high-energy capacity battery (usually 30-100kWh), which can be charged from the power grid. If a two-way charger is used, the car can be used as a power supply for V2G and V2H applications.

Battery electric vehicle (all-electric vehicle, BEV): only the motor (without ICE motor), using a high-power, high-energy capacity battery (usually 30-100kWh), which can be charged from the power grid. If a two-way charger is used, the car can be used as a power supply for V2G and V2H applications.

Fuel electric vehicle (FCEV, FCV or hydrogen-powered vehicle): It has only motor (without ICE motor), and is usually called hydrogen-powered vehicle. Actually, it is an electric vehicle that generates electricity from hydrogen through fuel cell stack. FCEV contains batteries (or super capacitor banks) to achieve certain functions, such as braking energy recovery, etc. The battery is a high-voltage battery, which usually has a low energy capacity (several kWh). Some FCEV use larger batteries (about 10kWh, which can be charged from the power grid, similar to PHEV, to achieve cleaner driving (assuming that the charging electricity is generated by clean renewable energy sources, such as photovoltaic or wind energy). Two-way charger in FCEV can be used as power supply for V2G and V2H applications.

New Energy Vehicle (NEV): a term used by the Chinese government, including PHEV, BEV, FCEV, etc. The formulation of new energy vehicles can make the policies issued by the state more sustainable, cover more technical iterations, and help to achieve a smooth transition. Through periodic adjustment and withdrawal mechanism, enterprises are constantly encouraged to try new technologies. In traditional cars, there is a big gap between China and foreign countries, especially engines, which involve high technical barriers. Make new things, the gap with foreign countries is not big, in order to avoid being eliminated by foreign technology in the future.

In recent years, the xEV market has developed rapidly, thanks to the commitment of governments to achieve carbon neutrality in 2050. The adoption of electric vehicles is the key to reduce carbon dioxide emissions, and OEMs, Tier 1 and power semiconductor manufacturers will evolve with the growth of electric vehicles.

In xEV application, the system level involves main inverter and generator, boost converter, DC-DC converter and vehicle charger; Package types include discrete and power supply modules; Power devices include silicon MOSFET, silicon IGBT, silicon BJT (bipolar transistor), silicon carbide (SiC)MOSFET and gallium nitride (GaN)HEMT, etc.

BEV leads high-voltage technology

With the strict carbon dioxide emission reduction and carbon neutral targets of various countries, the automobile industry has taken a big step towards the electrification of automobiles. Although each OEM has different electrification strategies, especially in different regions, they have a common goal, that is, to increase the share of BEV in its fleet. Hybrid electrification is still an option in the next 10-15 years, although it does not meet the long-term goal of carbon neutrality.

Despite the influence of the COVID-19 epidemic, the BEV technology driven by global electrification is still accelerating, the power electronic devices in different converters such as traction inverter, DC-DC, OBC (on-board charger) continue to increase, the EV/HEV system is transitioning to 48V, and the battery trend is also changing from 400V to 800V.

The choice of electrification is directly related to the choice of technical architecture of converter power or battery capacity, which will lead to completely different performance characteristics of different vehicles. Yole expects that in the next five years, with the addition of 48V batteries in automobiles, the power semiconductor market related to MHEV will continue to grow. In addition, from hybrid vehicles to BEV, the semiconductor content of each vehicle will increase with the improvement of electrification level.

As a matter of fact, BEV is promoting the rapid development of this technology. In this respect, users obviously require to drive a longer distance in a shorter charging time, while reducing the cost. There are several ways to increase the driving range, such as optimizing the battery design to increase its energy capacity or improve the inverter efficiency. On the other hand, in order to reduce the battery charging time, high-power chargers (up to 350kW) are deployed all over the world. In order to avoid the challenges associated with high current levels, the development trend is to increase the battery voltage. Increasing the battery voltage from the current 400V to 800V can realize faster charging and provide high added value for car users.

In fact, Porsche and Hyundai have already adopted 800V batteries, and other companies will follow suit. As the main inverter operates at a higher voltage, its power semiconductor components must also have a higher voltage rating, usually 1200V V. The transition from 600V-750V components to 1200V components has brought new business opportunities to some suppliers, while the business of others will be reduced. The choice of vehicle electrification and different technology choices will lead to different strategies adopted by major OEMs.

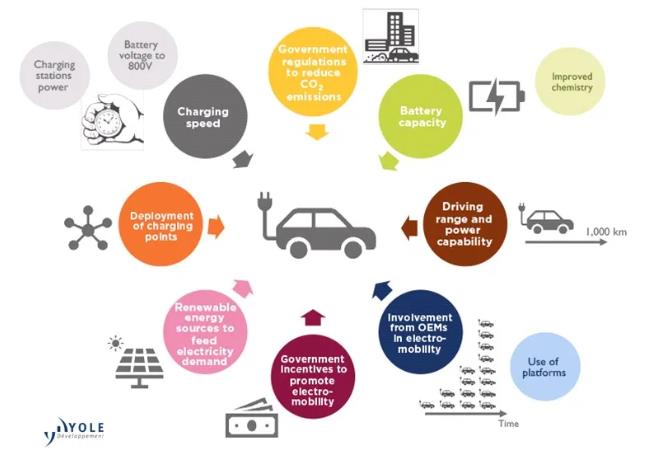

Main driving factors of electric vehicles

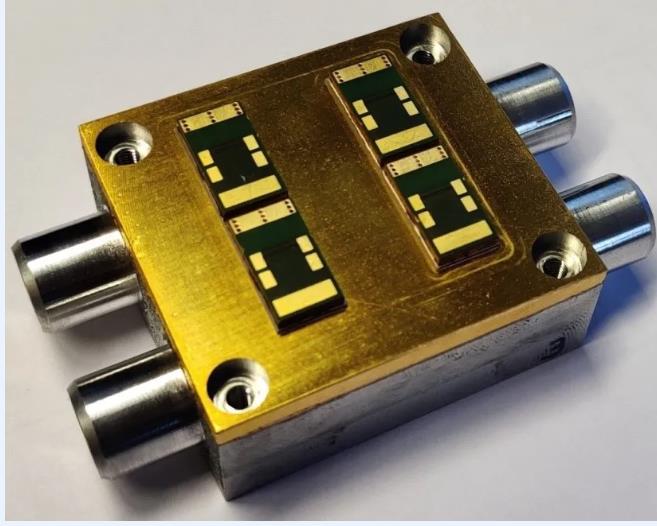

The cruising range of electric vehicles is not only determined by the battery, but also the efficiency of the whole power system plays an important role. A team of Flawn Hof Institute for Reliability and Micro-integration (IZM) in Berlin is developing an electronic control unit-power inverter for Porsche pure electric Mission E power system, which can convert the energy between battery and motor more effectively than the existing scheme.

Porsche SiC power inverter

Researchers and experts of their industry partners use particularly efficient SiC semiconductor transistors to ensure that the power consumed by current flowing through the transistors is smaller. They want to use the least number of transistors, because each SiC device will consume some energy and have to be cooled. Researchers redesigned the cooling elements of the power inverter to achieve the best cooling effect. By optimizing the transmission system in this way, the mileage of electric vehicles will eventually increase by 6%.

To solve the problem that different materials of power module have different expansion rates, the new cooling element adopts very thin metal plate to compensate the stress caused by slight deformation during heating or cooling, and prolong the service life. To reduce the stress of the power inverter module, the structure composed of cooling elements and SiC transistors is connected with the rest of the electronic system by twisting flexible thin copper wires to prevent cracks. It can be seen that the 800V high-voltage system is just where the high-temperature performance of SiC can be used.

Traction inverter is a big demand for power electronic devices.

There are basically three types of converters in EV/HEV: main inverter, DC-DC converter, generator and OBC. Because of its high power level, the main inverter is the largest market in the converter, with the highest power semiconductor content. Therefore, the main inverter market is expected to reach USD 19.5 billion by 2026, accounting for 67% of the EV/HEV converter market, with a compound annual growth rate of 26.9%.

With regard to the power semiconductor market, due to the significant technical competition between IGBT and SiC modules, its value is expected to triple from 2020 to 2026. In fact, the current cost of SiC module is still about three times that of 650V IGBT module, but when the production batch is larger, with the transition to 8-inch wafers and the popularity of 1200V devices with higher battery voltage, this gap will gradually narrow.

EV/HEV supply chain continues to be affected by the increasing demand and technology trends. Although the leading EV/HEV semiconductor manufacturers are consistent with other semiconductor manufacturers for power applications (such as Infineon, stmicroelectronics, Hitachi, Mitsubishi Electric, and Anselme), other companies (Tier 1, OEM, power semiconductor manufacturers, and pure module newcomers) are also providing power modules for EV/HEV.

A similar situation occurs in the field of battery design and manufacturing, and OEMs such as Tesla and General Motors are further trying to control their supply chains. Competition at the OEM level has also opened up two main tracks: one is that traditional OEMs with mature markets and well-known brands are turning their business to electric vehicles; On the other hand, pure electric vehicle OEMs are emerging in different parts of the world (such as Weilai, Rivian, Rimac, Tucki and Hezhong), and some of them, led by Tesla, are rapidly increasing their sales year by year. The new models introduced usually have better cost performance, which leads to the continuous reshaping of the sales of the top ten cars.

XEV power semiconductor device market (million USD)

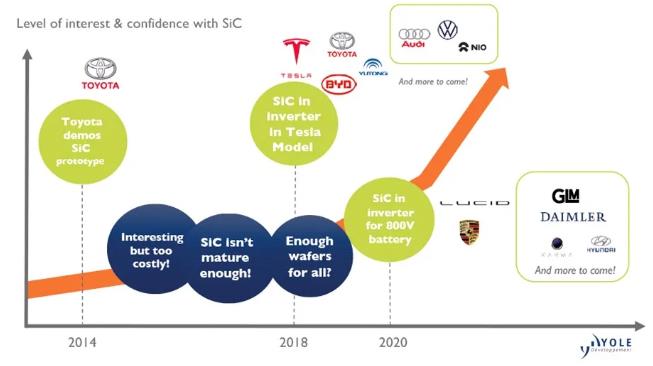

SiC walks on the red carpet of EV/HEV

Now, cars that don't use SiC are embarrassed to call electric travel. In the past few years, especially since Tesla introduced SiC into its Model 3 main inverter, the adoption of SiC in EV/HEV has caused great repercussions. But not all converters or all types of electrified vehicles are suitable for this expensive material.

There is no doubt that BEV is the winner of adopting SiC, because it requires long mileage and fast charging time. Therefore, with the improvement of converter efficiency, the increased converter cost is compensated, thus saving the battery cost. Therefore, it is not surprising that the use of SiC in the main inverter has become the common goal of major OEMs, and Daimler and Hyundai soon incorporated it into the main inverter.

Although the cost of SiC devices is higher than that of silicon devices, it helps to reduce the battery cost and increase the cruising range, thus effectively reducing the cost of the whole vehicle. Using SiC inverter can save about $200 per car, and reduce the size and weight of the main inverter.

Nowadays, Infineon, Cree(Wolfspeed) and stmicroelectronics have introduced a series of devices with SiC chips. Many semiconductor manufacturers regard SiC modules as the target of electric vehicle applications. It is estimated that by 2026, the SiC module market will account for 32% of the EV/HEV semiconductor market.

Echo of SiC and 800V

Although each OEM has its own SiC adoption strategy, Tesla has significantly improved its performance with SiC technology, and the adoption of 800V battery has also increased the use of SiC, and more OEMs are following up. At present, Shanghai Volkswagen, Nissan, BYD, Beiqi New Energy and Geely all use SiC devices in OBC and DC-DC of some of their models; Tesla, BYD, Yutong Bus, Geely, etc. used SiC devices in motor controllers; More car companies will adopt SiC in the main inverter, including Hongqi, Beiqi New Energy, Jianghuai Automobile, Hyundai, Honda, BMW, Audi, and new car makers Weilai, Tucki, Ideality, etc. Many Tier 1 companies have also released SiC electric drive plans, including Bosch, Delphi, ZF, Valeo, Weipai Technology, Jingjin Electric and so on.

One thing is certain, whether the technology is good or bad, the application is the best. In the automotive field, SiC devices will coexist with silicon-based devices for a long time. In terms of localization, compared with foreign countries, there is still a certain gap in the manufacturing process of domestic SiC devices, especially the yield rate needs to be further improved. Another key question is whether car companies dare to use domestic devices, which requires a certain courage and scientific attitude, and it takes some time to test and verify on the road.

Speed-up batch introduction of electrification

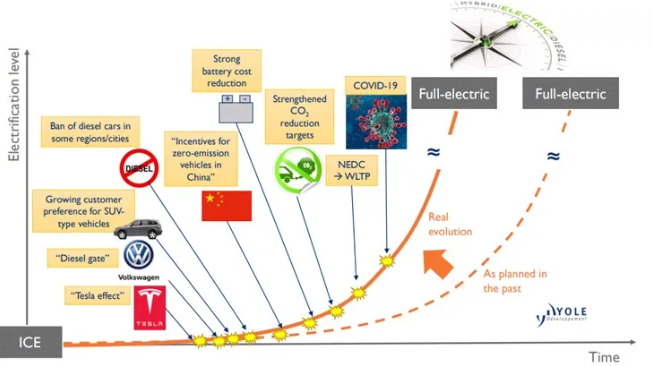

The implementation of the initial strategy of vehicle electrification is accelerating, because diesel vehicles are banned in some areas/cities, and customers' preference for SUV vehicles is increasing. Volkswagen's "diesel door", "Tesla effect", incentives for zero-emission vehicles in China, battery cost reduction, carbon dioxide emission reduction target, NEDC (New European Driving Conditions) →WLTP (Global Unified Light Vehicle Test Procedure), including the COVID-19 epidemic, are all promoting the process of vehicle electrification.

Vehicle electrification acceleration

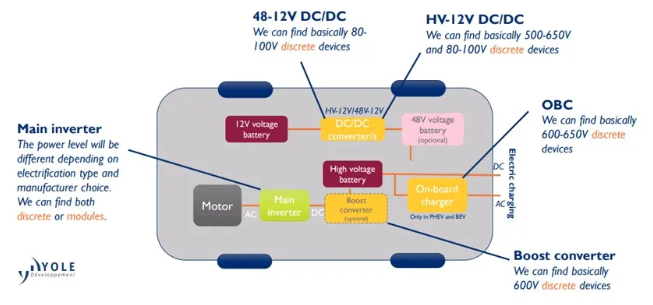

At present, in the power electronics technology of EV/HEV, the main inverter can be either a discrete device or a module according to the electrification type and the different power level selected by the manufacturer. The 48-12V DC-DC is basically an 80-100V discrete device; HV-12V DC-DC is basically a 500-650V and 80-100V discrete device; OBC is basically a 600-650V discrete device; The boost converter is basically a 600V discrete device.

Power devices used for each xEV type

Therefore, modules, especially SiC power devices and modules, have a large space for introduction. Some foreign OEMs began to use SiC Schottky barrier diodes and MOSFET on OBC in 2018. After that, the market penetration rate continued to increase, and then they transitioned to motor controllers and main inverters with higher reliability requirements. This is also the process of transition from discrete devices to all-SiC modules.

The highest demand for import is electric vehicles with long cruising range. It is expected that the SiC penetration rate of motor controllers of vehicles with cruising range of over 500km will be close to 100% by 2024; The overall penetration rate of vehicles under 500km can reach 40%.

Undoubtedly, almost all OEMs of electric vehicles have included the application of SiC devices in new project development plans, and it is expected that SiC will become the explosive node in the electric vehicle market in 2025.

Disclaimer: This article is reproduced from "TechSugar". This article only represents the author's personal views, and does not represent the views of Sacco Micro and the industry. It is only for reprinting and sharing to support the protection of intellectual property rights. Please indicate the original source and author when reprinting. If there is any infringement, please contact us to delete it.

Company Tel: +86-0755-83044319

Fax/fax:+86-0755-83975897

Email: 1615456225@qq.com

QQ: 3518641314 Manager Li

QQ: 332496225 Manager Qiu

Address: Room 809, Block C, Zhantao Technology Building, No.1079 Minzhi Avenue, Longhua New District, Shenzhen

Site Map | 萨科微 | 金航标 | Slkor | Kinghelm

RU | FR | DE | IT | ES | PT | JA | KO | AR | TR | TH | MS | VI | MG | FA | ZH-TW | HR | BG | SD| GD | SN | SM | PS | LB | KY | KU | HAW | CO | AM | UZ | TG | SU | ST | ML | KK | NY | ZU | YO | TE | TA | SO| PA| NE | MN | MI | LA | LO | KM | KN

| JW | IG | HMN | HA | EO | CEB | BS | BN | UR | HT | KA | EU | AZ | HY | YI |MK | IS | BE | CY | GA | SW | SV | AF | FA | TR | TH | MT | HU | GL | ET | NL | DA | CS | FI | EL | HI | NO | PL | RO | CA | TL | IW | LV | ID | LT | SR | SQ | SL | UK

Copyright ©2015-2025 Shenzhen Slkor Micro Semicon Co., Ltd