Service hotline

+86 0755-83044319

release time:2022-03-08Author source:SlkorBrowse:16377

(Continued from Part I: Integrated Circuit Design, Part II: Integrated Circuit Manufacturing, Part III: Basic Packaging, Test, and Advanced Packaging)

5. Semiconductor product manufacturing equipment

(1) Outline of Semiconductor Manufacturing Equipment Small and Medium Enterprises

There are many types of semiconductor products processing and manufacturing equipment used by small and medium-sized enterprises in each process of the semiconductor production line. There are semiconductor-specific equipment (pre-processing) for manufacturing bare wafers (materials), equipment for processing bare wafers into final wafers (post-processing), and equipment for manufacturing photomasks (mask production). Chipmakers need a variety of front-end equipment on their production lines. The cost of complex front-end semiconductor fabrication equipment is a major reason for the high cost of semiconductor fabs, including the cost of building ultra-clean fabs.

Front-end semiconductor fabrication equipment includes equipment for chip fabrication processes such as photolithography, etching, doping or ion implantation, deposition, polishing, or chemical mechanical planarization. Of particular note are metal-organic chemical vapor deposition (MOCVD) equipment, a specific type of deposition equipment that deposits thin layers of certain metals, primarily used to produce compound semiconductors, including those based on GaAs and GaN.

Back-end semiconductor manufacturing equipment SME includes ATP and advanced packaging equipment.

(2) Current situation

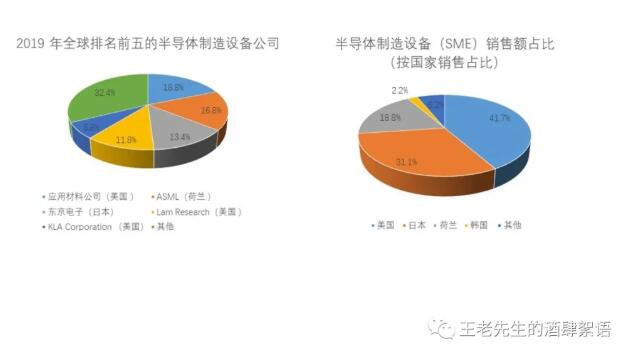

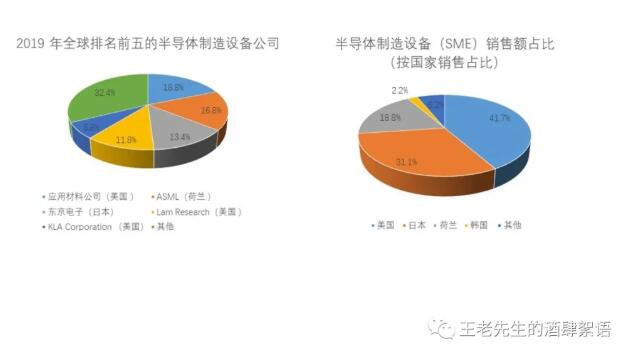

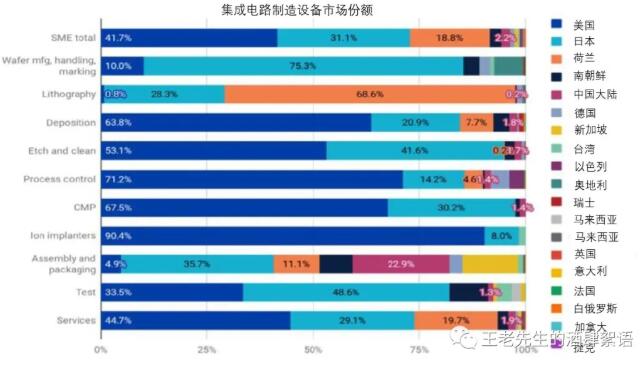

Semiconductor manufacturing equipment is dominated by companies in the US (41.7% share in terms of sales revenue), Japan (31.1%) and the Netherlands (18.8%). South Korea has a 2.2% share, with the remaining roughly 6.2% shared by China, Germany, [敏感词], Israel, Canada, and other countries in Southeast Asia and Europe. Most of South Korean semiconductor manufacturing equipment manufacturers are owned by Samsung or SK Hynix, the main customers of these South Korean semiconductor equipment companies are South Korean semiconductor companies. Although there is also a Chinese company that manufactures different types of semiconductor manufacturing equipment, Chinese companies do not have a significant share of any semiconductor manufacturing equipment category except back-end assembly, packaging equipment and MOCVD.

All in all, the US accounts for a large share of global production of most front-end semiconductor production equipment, with the exception of lithography equipment production that is concentrated in the Netherlands and Japan. The U.S. also accounts for a large share of global production of back-end test equipment. In contrast, the United States has a relatively small market share in the global back-end semiconductor production equipment manufacturing (assembly and packaging equipment), while China has a considerable share. While China is currently highly reliant on non-Chinese-sourced semiconductor production equipment (except for packaging and MOCVD), it is investing heavily to focus on producing such equipment. These investments give the beneficiary companies a significant advantage in developing and producing cutting-edge chip equipment relative to other companies.

As the chart below shows, while the U.S. has a sizable market share in the production of most front-end SMEs, the notable exception is lithography scan/stepper equipment, which is almost entirely made by Dutch company ASML and Japanese companies Nikon and Canon. For lithography machines, ASML (Netherlands) is the only producer of EUV steppers/scanners, which are critical for the production of integrated circuits with line widths of 5 nm or less. However, only two semiconductor makers, [敏感词] and Samsung, currently use EUV machines in production, with a single device costing more than $100 million. ASML and Nikon both manufacture deep ultraviolet (DUV) lithography machines that project a beam of light through a photomask and create a scaled-down image of the photomask pattern on the wafer. Outside of the Netherlands and Japan, the US and other countries' share of lithography equipment is mainly for specific low-volume chips or for making photomasks.

A set of semiconductor manufacturing equipment can have as many as 100+ parts, and semiconductor manufacturing equipment parts and accessories are the largest trade category in the industry. According to the Manufacturers Census survey, half of U.S. semiconductor manufacturing equipment sales revenue goes to components and other materials. More than 130 U.S. companies supply critical components for equipment sold by foreign companies. Notably, Cymer (USA) manufactures lasers for ASML's EUV stepper/scanner lithography machines. ASML acquired Cymer in 2013, but Cymer remains an independent US-based operating unit of ASML.

Because of the cyclical nature of sales due to limited markets and customers, most large equipment companies manufacture more than one type of equipment in order to provide customers with a full suite of equipment and maintenance options. Lithography stepper/scanner equipment companies such as ASML are exceptions to this rule due to the unique technology of the equipment. Lam Research, Tokyo Electron (TEL) focus on deposition and etching, while KLA focuses on metrology and inspection.

One exception to the lead in Japan and the Netherlands is MOCVD equipment, which is used to produce semiconductors made from materials other than silicon such as GaN and GaAs, including LEDs, laser diodes and other photonic chips, power/RF devices and solar cells. As mentioned above, GaN chips have strategic defensive implications. MOCVD equipment is manufactured by Veeco (USA), Aixtron (Germany) and AMEC (China). China is trying to gain market share in the MOCVD market through acquisitions. In 2016, the Chinese entity Fujian Grand Chip Investment Fund, a company formed for the deal, including state- and regionally-owned institutions, attempted to acquire Aixtron, but the deal was blocked by President Obama after a review by the Committee on Foreign Investment in the United States (CFIUS), potentially of the acquirer abandoned the takeover offer.

The top three companies for etching equipment are Lam Research (US), Tokyo Electron (Japan), and Applied Materials (US). Chinese companies, including AMEC, have some expertise in etching and can provide equipment for low-end applications, however, their market share is only around 1%.

The U.S. has a relatively small market share (4.9%) in back-end packaging SMEs compared to front-end semiconductor manufacturing equipment. Japan has the largest share of packaging equipment (35.7%), followed by China (22.9%) and the Netherlands (11.1%). However, US-based Kulicke and Soffa is a leading semiconductor packaging equipment company. The U.S. and Japan lead the way in back-end test equipment (ATP) with 33.5% and 48.6% market share, respectively.

(3) Semiconductor manufacturing equipment, the risk of the United States

Reliance on foreign (non-U.S.) sales:

While the U.S. has a large share of the semiconductor production equipment market, U.S. producers are highly dependent on foreign sales. As the largest semiconductor manufacturers, [敏感词], China and South Korea are the largest markets for semiconductor production equipment. Although [敏感词] is expected to regain its position as the largest market for semiconductor production equipment in 2021 and 2022, due to the heavy spending required by chip fabs, Applied Materials and Lam Research report that about 90% of its total 2020 revenue will come from non- US sales. Lam Research's revenue from China increased from 16% in 2018 to 31% in 2020. As a result, U.S. semiconductor production equipment makers are at risk of being significantly impacted by U.S.-China trade restrictions or unexpected demand changes in Asia. The resulting impact could go well beyond the current revenue decline, as semiconductor manufacturers experience a degree of device lock-in, and changing device suppliers requires costly redesigns. For example, Lam Research noted in its 2020 annual report, "Once a semiconductor manufacturer commits to purchasing a competitor's semiconductor manufacturing equipment, the manufacturer typically continues to purchase that competitor's equipment, making it harder for us to sell us to that customer in the future. equipment.” In addition, sales of semiconductor production equipment are limited to universities and semiconductor manufacturing companies that own fabs. Semiconductor production equipment companies cannot grow their customer base outside of these categories because such equipment is unique to the semiconductor industry.

Chinese subsidies for the production of semiconductor manufacturing equipment distort the market:

In addition, China plans to provide substantial subsidies to finance the production of semiconductor production equipment in the country. The second phase of the China National Integrated Circuit Industry Investment Fund focuses on etching machines, deposition equipment, testing and wafer cleaning equipment, with funding ranging from $28.9 to $47 billion. The subsidies keep Chinese companies in business, even though most appear to be unprofitable. For example, according to the Organisation for Economic Co-operation and Development (OECD), “government capital injections have had a clear impact on the financial performance of Chinese semiconductor producers,” where increases in corporate assets have not been matched by growth in profitability. These subsidies provide Chinese companies with funds to invest in research and development in next-generation semiconductor manufacturing, giving them a significant advantage over non-Chinese companies that do not receive such subsidies. Unlike in the past, semiconductor production equipment manufacturers today are reluctant to invest in R&D for next-generation wafer sizes, given the substantial R&D and capital expenditures to manufacture semiconductor production equipment and the uncertainty of when and where leading-edge chip production will be made.

Site Map | 萨科微 | 金航标 | Slkor | Kinghelm

RU | FR | DE | IT | ES | PT | JA | KO | AR | TR | TH | MS | VI | MG | FA | ZH-TW | HR | BG | SD| GD | SN | SM | PS | LB | KY | KU | HAW | CO | AM | UZ | TG | SU | ST | ML | KK | NY | ZU | YO | TE | TA | SO| PA| NE | MN | MI | LA | LO | KM | KN

| JW | IG | HMN | HA | EO | CEB | BS | BN | UR | HT | KA | EU | AZ | HY | YI |MK | IS | BE | CY | GA | SW | SV | AF | FA | TR | TH | MT | HU | GL | ET | NL | DA | CS | FI | EL | HI | NO | PL | RO | CA | TL | IW | LV | ID | LT | SR | SQ | SL | UK

Copyright ©2015-2025 Shenzhen Slkor Micro Semicon Co., Ltd