Service hotline

+86 0755-83044319

release time:2022-03-17Author source:SlkorBrowse:12465

In the past three or four years, with the "ZTE Incident" as a guide, in the turbulent waves, from the front line of the industrial economy to the capital market, they have all turned into a specific time and space. Hard technology has thus become the keyword of the times. Among them, the semiconductor industry with chips as the core has attracted the most attention.

Until the last quarter of 2021, we will do a review and record the following notes:

(1) Overview of China's semiconductor industry

1. Objective facts about fundamentals

2. China Semiconductor Events

3. Supply and demand difference + investment overweight + domestic substitution + engineer bonus = high growth

(2) Industry Chain Overview and Core Segmentation

1. Overview: Three Rings of the Industrial Chain and Two Supporting Industries

2. Several segments worthy of investors' attention

(3) Chip Design

1. Industry status, overview and localization

2. Brief analysis of leading companies

(4) Wafer Manufacturing

1. Industry status, overview and localization

2. Brief analysis of leading companies

(5) Package test

1. Industry status, overview and localization

2. Brief analysis of leading companies

(6) Semiconductor materials

1. Industry status, overview and localization

2. Brief analysis of leading companies

(7) Semiconductor equipment

1. Industry status, overview and localization

2. Brief analysis of leading companies

01

China Semiconductor Industry Overview

[1] Objective facts about fundamentals

Two months ago, semiconductors, one of the three Musketeers in the stock market, were in full swing, and a screenshot of WeChat "How old are you?" came out, causing an uproar in the market.

The whole story of the incident will not be repeated. In any case, this is another farce in the capital market. What we can also learn from this is that behind the success of 5G, "localization of high-end industries" seems to be a recipe for sellers to take advantage of investors.

Labeling an industry with "stuck neck" and "domestic substitution" makes you feel that you are standing on the commanding heights of ethics, and your emotions begin to become subjective, conceited, and agitated. Use this market's favorite emotional logic to arbitrarily play a stick and swing it towards All the empty forces, completely disregarding right and wrong.

So what we ordinary investors can do, first of all, must be clear about the objective situation of my country's semiconductors, respect the facts, and blind confidence is not advisable.

How about my country's semiconductor strength? In general, due to problems such as late start, chaotic investment, high demand, imperfect talent system, and overseas situation, my country's semiconductor industry currently has a shortage of talents, limited technology, a significantly backward high-end industrial chain, and dependence on imports.

The late start leads to the loss of preemptive opportunities, and domestic foundry path dependence, investment confusion, talent treatment and other issues also limit my country's semiconductor technology, especially the mismatch between high-end chip design capabilities and manufacturing capabilities, and the lack of core technologies. It is expected that There has been no significant improvement for a long period of time.

The most typical is the wafer manufacturing process. Now China can only complete the manufacture of 14nm products. In the same period, foreign countries have realized the manufacture of 7nm or even 5nm products, which is 2-3 generations behind.

From the perspective of actual demand, China and the United States each account for about a quarter of the global semiconductor device consumption, which is very large. In terms of supply, the self-sufficiency rate of my country's semiconductor industry chain is only 17.5%, and it is highly dependent on imports. In 2020, China spent a total of 2.4 trillion yuan to buy chips, accounting for about 18% of total domestic imports. It is the largest imported category, far exceeding oil.

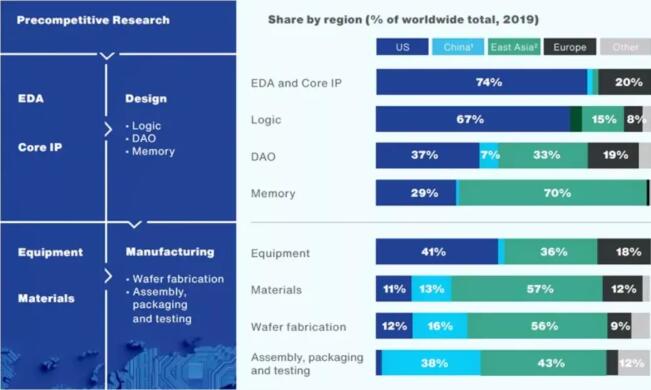

From the chart above, China's share of the global market is more specific. In terms of chip design, China only accounts for 3% in the EDA/IP field, 7% in the DAO field, and even less in the field of logic chips and memory chips, which is different from the cloud mud in the United States; in terms of wafer manufacturing, China accounts for 16% %, but basically low-end products; in terms of non-core packaging and testing in the three links of the semiconductor industry chain, China accounts for 38%; in terms of semiconductor materials, China accounts for 13%, but in the third generation of SiC, GaN, etc. The development of semiconductor materials is still 1-2 generations behind; in terms of semiconductor equipment, the proportion is very small.

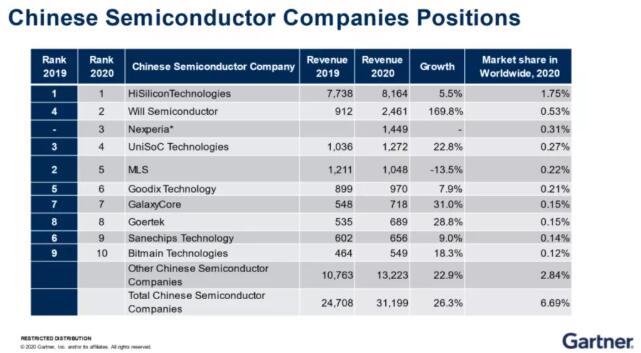

Looking at the market share ranking of my country's semiconductor companies in 2020, the first place HiSilicon has only 1.75% of the global cake, and due to well-known events, there has been a sharp decline this year. Except for HiSilicon, all other mainland semiconductor companies together account for 4.94% of the world, and none of them can be called international giants.

To sum up, compared with developed countries such as the United States, Japan and Europe, my country's semiconductor industry is significantly backward, and there are many criticisms in technology, production capacity, and talents. Therefore, it is imperative to develop my country's semiconductor industry and carry out domestic substitution to maintain supply chain security.

【2】China Semiconductor Events

Knowing the current situation of my country's industry, let's first explore in detail what China's semiconductors have done in the past, in order to have a certain contextual understanding of my country's semiconductor process.

On November 17, 1990, in order to promote the development of China's semiconductor industry, the China Semiconductor Industry Association was established. On the occasion of its 30th anniversary, the association has selected 30 major events in China's semiconductor industry in the past 30 years based on online voting and industry expert opinions. I use the time as a line, and on this basis, I will simplify, filter "symbolic" events, and list 17 things that I personally think are the most practical for the development of domestic semiconductors.

(1) In August 1990, the "908" project started

In August 1990, the former Ministry of Machinery and Electronics Industry proposed the "908" project construction plan. The "908" project is a key construction project for the development of integrated circuits during my country's "Eighth Five-Year Plan" period. In 1993, the main body of the "908" project, Huajing Company, successfully trial-produced my country's first 256K DRAM.

(2) In 1992, the panda ICCAD system was successfully developed

In 1992, Beijing Integrated Circuit Design Center and other units successfully developed the Panda ICCAD system. This is the first large-scale ICCAD system developed and integrated by software engineering methods in my country, with completely independent intellectual property rights and complete functions, which has laid an engineering technical foundation for promoting the development of my country's integrated circuit design industry.

(3) In April 2000, SMIC was established

In April 2000, SMIC Integrated Circuit Manufacturing Co., Ltd. was incorporated in the Cayman Islands and headquartered in Shanghai, China. In September 2004, SMIC's first 12-inch chip factory in mainland China was successfully put into production in Beijing and entered the formal operation stage. In December 2008, SMIC announced that the first batch of 45nm products successfully passed the yield test. In August 2015, SMIC's 28nm products achieved mass production. In August 2019, SMIC announced that the 14nm FinFET process has entered the stage of customer risk mass production.

(4) In June 2000, the State Council issued "Several Policies for Encouraging the Development of Software Industry and Integrated Circuit Industry"

On June 24, 2000, the State Council issued the "Notice of the State Council on Printing and Distributing Several Policies to Encourage the Development of the Software Industry and Integrated Circuit Industry" (Document No. 18 of the State Council). Guofa No. 18 provides support from investment and financing policies, tax policies, industrial technology policies, export policies, etc., and encourages the development of the software industry and integrated circuit industry.

(5) Since 2003, leading foreign semiconductor companies have built factories in mainland China

In 2003, [敏感词] (Shanghai) Co., Ltd. settled in Shanghai Songjiang Science and Technology Park, engaged in the production of 8-inch chips. In 2005, SK Hynix built a semiconductor manufacturing plant, SK Hynix Semiconductor (China) Co., Ltd. in Wuxi, which mainly produces 12-inch chips. In 2007, Intel's Dalian factory started construction, and officially put into operation in October 2010. In September 2012, Samsung Electronics officially started construction of a memory chip project in Xi'an, mainly mass production of 10-nanometer NAND Flash, which was completed and put into production in May 2014. In July 2016, the [敏感词] project in Jiangbei New District, Nanjing started construction, and in May 2018, the first batch of 16-nanometer wafers was mass-produced and shipped.

(6) In April 2004, Spreadtrum launched the first TD/GSM dual-mode baseband single chip

In April 2004, Spreadtrum Communications (now merged into Ziguang Zhanrui) successfully developed and launched the world's first TD/GSM dual-mode baseband single-chip SC8800A, which achieved a comprehensive breakthrough in the core technology of mobile communication terminals and became my country's first international The communication standard TD-SCDMA has laid the foundation for the world.

(7) In October 2004, HiSilicon was established

On October 18, 2004, Shenzhen HiSilicon Semiconductor Co., Ltd. was established, formerly known as China's top technology enterprise Integrated Circuit Design Center. HiSilicon has successively launched the industry's first terminal chips supporting LTE Cat.4, Balong 710,The world's first 7nm flagship SoC Kirin 980, the world's first full set of WiFi6+ chip solutions Lingxiao 650, the industry's first flagship 5G SoC chip Kirin 990 5G and other processor products have become the largest chip design company in mainland China.

(8) In December 2005, the National Integrated Circuit Science and Technology Major Project was implemented

In December 2005, the State Council issued the "National Medium- and Long-Term Science and Technology Development Plan (2006-2020)", deploying major special projects for core electronic devices, high-end general-purpose chips and basic software products, and very large-scale integrated circuit manufacturing equipment and equipment. Complete set of major special projects. The implementation of the special project has greatly promoted the development of my country's high-end general-purpose chip design and integrated circuit equipment, wafer manufacturing, packaging and testing, and equipment and materials industries.

(9) In 2008, Hangzhou Zhongtian Micro launched the domestic embedded CPU C-SKY series

In 2008, Hangzhou Zhongtian Microsystem Co., Ltd. launched the domestic embedded CPU C-SKY series. The C-SKY series has achieved innovative breakthroughs in instruction sets, processor architectures and supporting tool chains and mass-produced them on a large scale. The cumulative authorized chip shipments have reached 2 billion. In 2018, Zhongtianwei was acquired by Alibaba and established Pingtouge Semiconductor.

(10) In June 2014, the State Council issued the "National Integrated Circuit Industry Development Promotion Outline"

In June 2014, the State Council issued the "National Integrated Circuit Industry Development Promotion Outline" (hereinafter referred to as the "Outline"). The "Outline" clarifies the five basic principles of "demand traction, innovation drive, combination of software and hardware, key breakthroughs, and open development", and proposes that by 2030, the main links of the integrated circuit industry chain will reach the international advanced level, and a number of enterprises will enter the world's first place. echelon.

(11) In October 2014, the National Integrated Circuit Industry Investment Fund was formally established

In October 2014, the National Integrated Circuit Industry Investment Fund was formally established. The fund focuses on investing in integrated circuit chip manufacturing, taking into account the chip design, packaging and testing, equipment and materials industries, and implementing market-oriented operations and professional management.

(12) Since 2014, domestic packaging and testing companies have started large overseas mergers and acquisitions

In December 2014, Changdian Technology issued an announcement to acquire Xingke Jinpeng, the fourth largest semiconductor packaging and testing company in the world. After this acquisition, Changjiang Electronics Technology Co., Ltd. has become the third largest packaging and testing factory in the world. In 2016, Tongfu Microelectronics acquired AMD's two high-end packaging and testing bases in Suzhou and Penang, Malaysia, and obtained high-end packaging and testing technology and mass production platforms for CPU, GPU, server and other products.

(13) In July 2019, 6 semiconductor companies were listed in the first batch on the Science and Technology Innovation Board

On the morning of July 22, 2019, the Science and Technology Innovation Board officially opened, and the first batch of 25 companies on the Science and Technology Innovation Board were officially listed and traded. Among them, there are 6 semiconductor companies, including Anji Technology, Zhongwei Company, Montage Technology, Huaxing Yuanchuang, Ruichuang Micronano, Espressif Technology, etc. According to the data, as of the end of 2020, a total of 42 semiconductor companies have been listed on the Science and Technology Innovation Board.

(14) Since 2019, memory companies in mainland China have made continuous breakthroughs

In September 2019, Changxin Storage launched the 10-nanometer first-generation 8Gb DDR4 chip synchronized with the international mainstream products, with a design capacity of 120,000 wafers per month in the first phase, marking my country's breakthrough in mass production technology in the field of memory chips. It fills the gap of DRAM in mainland China. In April 2020, YMTC released two types of 128-layer 3D NAND flash memory, namely 128-layer QLC 3D NAND flash memory and 128-layer 512Gb TLC (3 bit/cell) flash memory chips, which are basically in line with the international advanced level in the field of 3D NAND flash memory. Synchronize.

(15) In July 2020, the State Council issued "Several Policies for Promoting the High-quality Development of the Integrated Circuit Industry and Software Industry in the New Era"

In July 2020, the State Council issued the "Notice of the State Council on Printing and Distributing Several Policies for Promoting the High-quality Development of the Integrated Circuit Industry and Software Industry in the New Era" (Guo Fa [2020] No. 8, hereinafter referred to as "Several Policies"). The "Several Policies" support the high-quality development of the integrated circuit and software industry from eight aspects: finance and taxation, investment and financing, research and development, import and export, talents, intellectual property rights, market application, and international cooperation.

(16) In November 2020, Beidou Starcom released the 22nm Beidou high-precision positioning chip

In December 2012, my country officially announced the Beidou satellite navigation system signal-in-space interface control file (also known as the ICD file), and the industrialization and globalization of Beidou officially kicked off. In November 2020, Beidouxingtong released a new generation of 22nm Beidou high-precision positioning chip, and realized the integration of "baseband + radio frequency + high-precision algorithm" on a single chip for the first time.

(17) In December 2020, the Academic Degrees Committee of the State Council and the Ministry of Education set up the first-level discipline of integrated circuits

On December 30, 2020, the Academic Degrees Committee of the State Council and the Ministry of Education issued the "Notice of the Academic Degrees Committee of the State Council and the Ministry of Education on Establishing "Interdisciplinary" categories, "Integrated Circuit Science and Engineering" and "National Security" first-level disciplines", decided to Set up the first-level discipline of "Integrated Circuit Science and Engineering" (the discipline code is "1401"). This is of great significance to the construction of an innovative talent training system that supports the rapid development of the integrated circuit industry, and will promote integrated circuits to have more autonomy in discipline construction and talent training programs.

[3] Supply and demand difference + investment overweight + domestic substitution + engineer bonus = high growth

After discussing the past and present, let's examine the future that investors care most about.

Although my country's semiconductor industry started late, has experienced ups and downs, and is obviously lagging behind, but for investment, the poor current situation does not mean that investment cannot be made, and it may even breed very good investment opportunities.

In fact, in the past two decades, my country's semiconductors have developed rapidly as a whole, with a compound annual growth rate of about 20%, which has far exceeded the global average. In the next few years, I think it is expected to grow at a faster growth rate under the catalyst of various factors such as poor supply and demand, investment overweight, domestic substitution, and engineer bonus.

(1) The first is the difference between supply and demand. After the epidemic, with the resumption of work in all walks of life, the accelerated popularization of 5G, the continued popularity of new energy vehicles, the overall supply and demand of the semiconductor industry chain has gradually become unbalanced, the prosperity has risen rapidly, and the shortage of cores has become more and more serious, which has lasted for nearly a year. Long.

Under these conditions, many domestic semiconductor companies have increased both in volume and price, and this year's performance has grown brightly. The same is true abroad. Qualcomm expects 5G mobile phone shipments to at least double year-on-year. Micron’s DRAM and NAND Bit demand growth is expected to be between 20% and 30%. Infineon expects revenue in the electric vehicle field to increase by 40%. CREE, The supply of production capacity such as ASE and ASML is still very tight.

Gartner expects the lack of cores to be delayed until the second quarter of 2022. To examine the internal reasons for the imbalance between supply and demand, Sheng Linghai, research vice president of Gartner, believes that the reasons for the current global chip shortage include both accidental and inevitable factors.

Accidental factors are the Sino-US trade frictions in the past, China's top technology enterprise's stockpiling of goods and the closure of some factories. Among them, the Sino-US trade disputes have caused some domestic companies to stock up. After the market was out of stock, many large companies also increased their inventory requirements, causing the overall demand to greatly exceed the capacity that could be provided.

The inevitable factor is that in the entire semiconductor cycle, there will be a cycle in about three or four years, and it is currently in a peak cycle of short supply. Looking at the previous wave, in the semiconductor boom in 2017, a group of companies made a lot of investment. In 2019, the production capacity was released, the supply exceeded demand, and the enterprises tightened investment, resulting in the current shortage of production capacity.

(2) When it comes to corporate investment, it leads to the second factor I want to express, that is, investment overweight.

It can be seen in the 30-year memorabilia that the Chinese government and enterprises have made a lot of investment in the semiconductor industry, and at the current stage of this cycle and the international situation, investment will inevitably increase, which is conducive to the growth of my country's semiconductor primary and secondary markets. and catch up.

Historically, [敏感词] has basically seen a jump in capital expenditure every 10 years. In 2019, it has already started a large capital investment. Under the second influence of tight supply, this year, [敏感词] announced in January and April that it will spend 25 billion yuan. To 28 billion US dollars, 100 billion US dollars of investment in three years to expand production.

Look abroad. In February this year, the 19 EU countries launched the "chip strategy", planning to invest about 50 billion euros (386 billion yuan) in the European chip industry to build Europe's own semiconductor ecosystem. In order to reduce dependence on non-European technologies, the EU also launched The "2030 Digital Compass" plan, hoping to produce 20% of the world's cutting-edge semiconductors by the end of the 2020s;

On May 11, 64 US companies jointly announced the establishment of the Semiconductor Alliance (SIAC) to urge the US Congress to pass the $52 billion "Semiconductor Incentive Plan". On the 13th of the same month, the US Senate officially approved the "Semiconductor Incentive Plan". ;

On the same day as the U.S. approval, the South Korean government released the "K-Semiconductor Strategy", which will plan semiconductor industry clusters in Gyeonggi-do and Chungcheong-do, integrating semiconductor design, raw materials, production, components, and cutting-edge equipment, aiming to dominate the world In the semiconductor supply chain, by 2030, the Korean government and 153 companies will also invest 510 trillion won in the semiconductor field.

(3) It can be seen that the two factors mentioned above are not only applicable to China, but also the trend of semiconductors in the world. And returning to the "How old are you?" incident at the beginning of the article, no matter how the two argue, no matter how pessimistic the situation in our country is, the domestic substitution factor is indeed unique to our country, and it is also a major issue that is taking place. opportunity.

Facing the predicament of a self-sufficiency rate of only 17.5%, facing the huge loss of spending 2.4 trillion yuan to buy chips a year, facing the unbearable fact that technology is almost completely backward, facing the supply that China's top technology enterprise is easily stuck in the neck as a symbol Chain risk, my country's semiconductor industry should be the beneficiary with the greatest opportunity and the clearest logic in the context of domestic substitution.

The "Several Policies for Promoting the High-Quality Development of the Integrated Circuit Industry and Software Industry in the New Era" issued by the State Council in 2020 pointed out that China's chip self-sufficiency rate will reach 70% by 2025, and the high growth rate is self-evident. Gartner predicts that the share of Chinese semiconductor companies in the domestic market will have the opportunity to exceed 30%.

(4) From the perspective of talents, the dividend factor of engineers is the key pillar for my country's semiconductor companies to expand their profits.

According to Chinanews.com, there are currently more than 1.4 million ordinary undergraduate graduates in engineering in China each year, which has become an important force in promoting the high-quality development of China's economy. It is increasing year by year, there are many talents, and it is cheap.

On December 30, 2020, the Academic Degrees Committee of the State Council and the Ministry of Education issued the "Ministry of Education of the Academic Degrees Committee of the State Council on the establishment of "interdisciplinary" categories and "Integrated Circuits".Notice on the first-level disciplines of "Science and Engineering" and "National Security Studies", decided to set up the first-level discipline of "Integrated Circuit Science and Engineering" (the discipline code is "1401"), which is very helpful for building innovative talents who support the rapid development of the integrated circuit industry. The training system is of great significance, and will promote integrated circuits to have more autonomy in discipline construction and talent training programs.

In terms of international students, the proportion of returning students has increased from 21.56% in 2004 to about 80% in recent years, and more and more overseas students have returned.

02

Industry Chain Overview and Core Segmentation

[1]Overview: Three Rings of the Industrial Chain and Two Supporting Industries

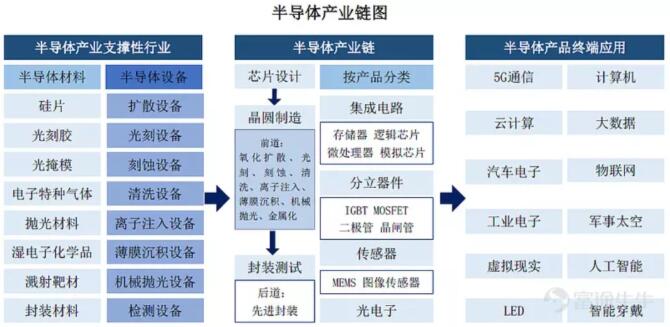

The semiconductor industry chain is divided into three links, chip design, wafer manufacturing, packaging and testing. Chip design can be understood as the design of densely packed transistors into integrated circuits, wafer manufacturing is to manufacture the designed integrated circuits, and packaging testing is to package and test the fabricated wafer integrated circuits.

The manufacturing process of semiconductors is extremely complex and difficult, with extremely high technical barriers, requiring the support of various materials such as silicon wafers, photoresists, special gases, sputtering targets, and high-end semiconductor equipment such as lithography machines and single crystal furnaces.

The specific situation, status, and subdivision of leading companies of these three links in the industrial chain and the two supporting industries of materials and equipment will be studied in five parts in the following sections.

In addition, as we all know, the market size and capital capacity of semiconductors are among the best in all industries, and the downstream applications are particularly extensive, including computers, mobile phones, consumer electronics, industrial electronics, automobiles, communications, aerospace, etc. social life.

[2]Several segments worthy of investors' attention

China's semiconductor industry chain is so large, how to identify which segments are the most worthy of attention, so as to really help our investment?

This matter is most suitable for the country. The experts who formulate policies not only have a deep understanding of the problems that the industry needs to solve, but also promote the will of the country. From the memorabilia of my country's semiconductor development, we can know that the government has launched a series of policy support including 908, 909 projects, Guofa No. 18 document, "National Integrated Circuit Industry Development Promotion Outline", and the 13th Five-Year Plan, which are most worthy of our support. The focus should be on the subdivisions of the key support for the semiconductor industry in the 14th Five-Year Plan.

(1) In terms of wafer manufacturing, it is necessary to speed up the development of advanced processes, and promote 14nm, 7nm and even more advanced manufacturing processes to achieve large-scale mass production.

(2) In terms of chip design and packaging and testing, the 14th Five-Year Plan will focus on supporting and guiding memory chips, embedded MPUs, DSPs, AP fields, analog chips and high-end power devices, and is committed to solving these key areas Neck problem. In addition, advanced packaging of logic chips and packaging of power devices will be the focus of development.

(3) In terms of key equipment and materials, the 14th Five-Year Plan will provide special support for some key "stuck neck" equipment and materials, such as lithography machines, large silicon wafers, and photoresists.

(4) The gap between domestic and international third-generation semiconductors is not that big compared with other fields, and there is an opportunity to achieve overtaking in corners, and some excellent companies have emerged in the domestic industrial chain from upstream to downstream. The third-generation semiconductors are written in 14 Five-year plan, it is expected that domestic manufacturers in this field will be in a state of vigorous development in the next five years.

Next, the panorama of A-share semiconductors will be reviewed again (2)

Site Map | 萨科微 | 金航标 | Slkor | Kinghelm

RU | FR | DE | IT | ES | PT | JA | KO | AR | TR | TH | MS | VI | MG | FA | ZH-TW | HR | BG | SD| GD | SN | SM | PS | LB | KY | KU | HAW | CO | AM | UZ | TG | SU | ST | ML | KK | NY | ZU | YO | TE | TA | SO| PA| NE | MN | MI | LA | LO | KM | KN

| JW | IG | HMN | HA | EO | CEB | BS | BN | UR | HT | KA | EU | AZ | HY | YI |MK | IS | BE | CY | GA | SW | SV | AF | FA | TR | TH | MT | HU | GL | ET | NL | DA | CS | FI | EL | HI | NO | PL | RO | CA | TL | IW | LV | ID | LT | SR | SQ | SL | UK

Copyright ©2015-2025 Shenzhen Slkor Micro Semicon Co., Ltd