Service hotline

+86 0755-83044319

release time:2022-03-17Author source:SlkorBrowse:11261

Continued A-share semiconductor panorama and re-review (1)

03

Chip Design

[1]Industry status, overview and localization

Chip design and wafer manufacturing are the core links in the semiconductor industry chain.

Chip design is located at the top of the upstream of the industry chain, and affects the function, performance and cost of the chip from the beginning, so it requires extremely high R&D strength of enterprises. The R&D investment in this link accounts for 53% of the entire semiconductor R&D. It is a typical talent and Intelligence-intensive industries.

However, this also brings the benefits of high added value. The asset-light model makes the overall gross profit margin of the industry above 30%, which is the most profitable link in the industry chain. Once the core underlying architecture technology is mastered, follow-up patent fees are possible. Reach more than 50% of the design cost.

The chip design process can be mainly divided into front-end design and back-end design. The front-end design is also called logic design, which mainly designs the function of the chip, and the back-end design is also called physical design, which mainly designs the process of the chip.

The business division mode can also be divided into IDM mode and Fabless mode, namely vertical integration mode and fabless mode. The former means that semiconductor manufacturers complete everything from chip design to chip manufacturing, with a large initial investment but can independently control the industry chain, representing companies such as Intel and Infineon;

The latter means that they are engaged in chip design work themselves, and wafer manufacturing is handed over to foundries such as [敏感词]. The assets are lighter but easily controlled by others. With the expansion of the scale effect, the Fabless model is becoming more and more mainstream. Representative companies such as NVIDIA, Qualcomm, China's top technology enterprise Wait, in the first quarter of this year, among the top 15 semiconductor companies in the world, the four with the highest revenue growth, AMD (93%), MediaTek (90%), Qualcomm (55%), and Nvidia (51%) are all in Fabless mode.

As we know above, China's chip designers account for only a single-digit global share, which is not on the same level as the United States. Although China's top technology enterprise HiSilicon is an excellent chip design company, but unfortunately the mainland wafer manufacturing industry lags behind too much, HiSilicon is still strangled by the throat and suffered heavy losses.

[2] Brief analysis of leading companies

UNIS Micro: It is one of the largest and leading listed companies in integrated circuit design in China. The subsidiary State Microelectronics has a complete product line and strong technical strength. It is the leading enterprise of special IC in China. The subsidiary Unigroup Tongxin is the domestic smart card chip leader, and the market penetration rate has been further improved. The subsidiary Unigroup Tongchuang is the domestic FPGA leader, and its product performance It has reached the top ten million gate level in the industry, breaking the overseas oligopoly, and it is expected to achieve rapid growth in the process of FPGA localization in the future.

Zhaoyi Innovation: Double leader in domestic flash memory chip memory and MCU microcontroller design, currently the world's No. 1 fabless NOR Flash supplier, and the world's No. 3 market share in the SPI NOR Flash field . NOR Flash products, based on the mature 55nm process platform, the company continues to launch competitive products for new market applications, Internet of Things, automotive applications, industrial control and other fields; in the MCU microcontroller market, sales will be close to 200 million in 2020.

Joint Micro: The domestic RF chip leader, deeply engaged in the field of RF front-end, has a leading edge in the domestic RF front-end segment, and is one of the few domestic RF device providers that benchmark against international leading companies.

Will Shares: The domestic image sensor design leader, successfully acquired two image sensor CIS design companies, OmniVision and Sbike, in 2019, and the design business revenue exceeds the tenth largest chip design listed company in the world. And increased research and development efforts in discrete devices, RF IC, analog IC and other fields, forming a business layout with CIS business as the core and coordinated development of multiple product lines.

Wingtech Technology: Nexperia, which was acquired at a cost of 18.1 billion, is a global leader in power semiconductors, and its products are mainly in the fields of consumer electronics and automobiles. Its main products are logic devices, discrete devices and MOSFET devices. It is a semiconductor multinational company integrating design, manufacturing, packaging and testing. Its three major businesses are all in the world's leading positions, with logic devices ranking second and diodes and transistors ranking first. , Vehicle power MOSFET ranked second.

Beijing Junzheng: Acquired Beijing Sicheng, which has a market share of 15% in the global automotive DRAM memory chip market, becoming a leading enterprise in automotive memory chips that is scarce in China.

New Clean Energy: A leading domestic MOSFET company, which has built its own IGBT packaging and testing production line, and its products have entered the supply chain of many domestic and foreign leading manufacturers such as CATL, ZTE, Philips, etc. It is one of the few domestic high-end power devices. One of the core technology manufacturers. In the future, it will be committed to building a third-generation semiconductor power device platform, and actively developing power semiconductors for new energy vehicles.

Fullhan Micro: The leader in security chip design. HiSilicon was sanctioned by the United States and passively withdrawn from the market. The company seized the opportunity in the process of switching the supply chain of downstream customers and achieved 80% substitution of HiSilicon products. In 2020, the company's market share in the field of security front-end ISP chips will reach 60%-70%.

Jingfeng Mingyuan: The first chip company in China to realize the localization of LED lighting driver chips, and its shipment volume ranks first in the world. Mastered the key technology of LED lighting driver chip design, and launched the overall solution of LED lighting driver, breaking through the monopoly of foreign chip companies on LED lighting driver chips.

Shengbang Co., Ltd.: The domestic analog chip leader, the two major product lines of analog chips are both power management chips and signal chain analog chips, two-wheel drive, benefiting from 5G, industrial drive, artificial intelligence and automotive upgrades.

Siripu: The domestic leading enterprise of signal chain analog chips, the comprehensive performance has reached the international standard. At the same time, it mainly focuses on signal chain analog chips, and gradually expands to power management analog chips.

Espressif Technology: The world's leading IoT WIFI-MCU chip company, with the world's largest market share, first-class hardware chip cost control capabilities, and complete software development ecosystem.

Rockchip: A multi-scenario SoC provider, with layouts in the fields of tablet, consumer electronics, OTT, payment, cloud computing, and security, focusing on power management, self-developed power performance and reliability indicators are at the market leading level.

04

Wafer fabrication

[1]Industry status, overview and localization

Wafer manufacturing is the most critical core link in the semiconductor industry and has the largest market share. It accounts for 13% of the entire semiconductor industry in terms of R&D, but capital investment accounts for 64%. The advanced manufacturing process has more than 500 processes, which is a typical capital-intensive process. type industry.

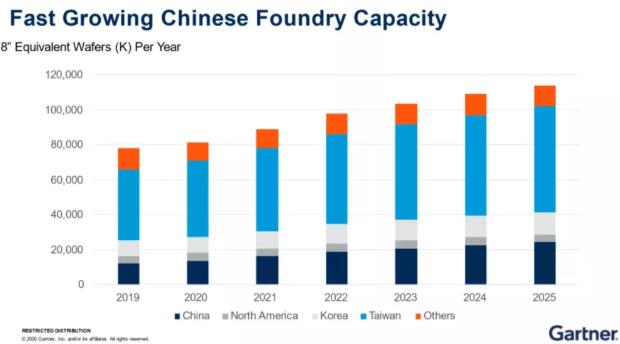

Mainland China currently accounts for 16% of the global wafer manufacturing capacity. It is expected that under the trend of the global foundry industry gradually shifting to Mainland China, it will continue to grow in the future, and the focus is on when to catch up with the world that is 2-3 generations ahead of my country. advanced technology.

The highest production capacity is China [敏感词] and South Korea, accounting for more than half of the shares, mainly [敏感词] and Samsung, which have the most advanced technology. The two plan to invest nearly 20 billion US dollars in the new 5nm process wafer factory. It is also prohibitive, thus forming strong technical and capital barriers.

[2] Brief analysis of leading companies

SMIC: The undisputed leader of domestic chip foundries, with the largest technology and scale in China, representing the most advanced manufacturing level for domestic replacement of integrated circuits, and the world's fourth largest market share. The demand for mature processes is strong, but the advanced processes that are stuck are restricted by politics and corporate games, and there is no obvious improvement.

Silan Micro: One of the leading power semiconductor IDMs in China, the company has put into production the first 12-inch power production line of domestic IDM manufacturers, continuously exerting efforts in the power semiconductor sector, and firmly taking the road of IDM. Business segments such as devices (mainly power semiconductor devices MOSFET, IGBT, diodes, etc.), integrated circuits (mainly including IPM, MCU, MEMS sensors, power management chips, digital audio and video circuits, etc.), LED chips and epitaxial wafers have been formed. , is the semiconductor IDM manufacturer with the most complete product line in China.

China Resources Micro: A high-tech enterprise under China Resources Group, a leading power semiconductor company in China, one of the leading domestic IDM manufacturers, and the largest MOSFET supplier. It is China's leading semiconductor company with integrated operation capabilities of the whole industry chain such as chip design, wafer manufacturing, packaging and testing. The R&D and production of SiC and GaN are going smoothly, SiC diodes have been supplied in small batches, the R&D of SiC-MOSFET products is coming to an end, and its industrialization preparations are progressing in an orderly manner, and GaN 6-inch and 8-inch products are being developed simultaneously.

Star Semiconductor: The leader in the domestic automotive-grade IGBT industry, and the seventh in the global IGBT module market. It is planned to build its own wafer production line for the production of high-voltage IGBT chips and SiC chips. After the project is put into production, it will form an annual production capacity of 360,000 power semiconductor chips. The SiC module products have been used in the core electronic control system of Yutong New Energy Bus. middle.

Saiwei Electronics: In 2016, Saiwei acquired the world's leading process IP through the acquisition of Sweden Silex, and entered the MEMS pure foundry track to become the global MEMS foundry leader. At present, the company can produce various devices such as microfluidics, micro ultrasonics, micro mirrors, and optical switches.

05

Package testing

[1]Industry status, overview and localization

The packaging and testing industry is located at the end of the semiconductor industry chain. The technologies of packaging and testing are relatively low-end, and the value is also low, which is a labor-intensive industry.

Therefore, with the advantage of cheap labor, China has increased its global share to 38% in the field of packaging and testing through resource integration and scale expansion. It is the link with the highest degree of localization in my country's semiconductor industry and the smallest gap with foreign countries.

[2] Brief analysis of leading companies

Changdian Technology: The leader in domestic packaging and testing, and the third in the world. It has a leading edge in the whole series of packaging and testing, and its business covers all high/medium/low-end categories. It can provide customers with full-process solutions from design simulation to middle and back-end packaging and testing, and system-level packaging and testing.

Tongfu Microelectronics: The world's fifth largest packaging and testing manufacturer, focusing on key customer strategies, long-term deployment of advanced packaging technologies for storage, microprocessor and other products.

Huatian Technology: The sixth largest packaging and testing manufacturer in the world, has been deeply involved in the packaging and testing field for several years, covering three categories of packaging and testing products: lead frame, substrate, and wafer level.

06

Semiconductor Materials

[1]Industry status, overview and localization

The semiconductor manufacturing process is quite complex, involving as many as 300 different materials. Therefore, semiconductor materials are also the most subdivided in the entire industry chain. Many of them require advanced technology and equipment to produce, with high technical and capital barriers. .

Silicon wafers, or wafers, account for more than one-third of the value of semiconductor materials and are the most important material. The previous article has done a more detailed exploration of the first, second and third generation semiconductor materials, and will not repeat them. In addition to silicon wafers, electronic special gases, photomasks, photoresists and auxiliary materials all account for between 10% and 15%, and are also important semiconductor materials.

my country's share of the global semiconductor manufacturing material market is 13%, slightly higher than the 11% of the United States, but it is still an old problem, mainly in the low-end. Domestic silicon wafers are mainly under 6 inches, and 8 inches and above rely on imports. The localization rate of electronic special gases and photoresists is also less than 20%. Other materials with high barriers such as sputtering targets and CMP polishing liquids are also used. Mostly rely on imports.

[2] Brief analysis of leading companies

Sanan Optoelectronics: On the basis of its solid leading position in the production and sales of LED chips, Sanan Integrated, a subsidiary of Sanan Optoelectronics, undertakes compound semiconductor business and has five major sectors: GaAs, SiC, GaN, optical communications and filters It is mainly used in new energy vehicles, photovoltaics, energy storage, server power supply, mining machine power supply and other fields.

BYD: BYD has invested heavily in the deployment of the third-generation semiconductor material SiC. At present, it has successfully developed SiC MOSFET. Its subsidiary BYD Semiconductor is the first in the world and the only one in China to realize the application of SiC three-phase full-bridge modules in new energy A power semiconductor company that is mass-loaded in automotive motor drive controllers. It is expected that by 2023, BYD will fully replace silicon-based power semiconductors for SiC-based vehicles in its electric vehicles.

Zhonghuan Co., Ltd.: Photovoltaic and semiconductor dual-wheel drive, mainly photovoltaic silicon wafers, but semiconductor silicon wafer production capacity has increased rapidly, 12-inch 20-year production capacity is 70,000 pieces/month Continue to increase the volume, the production capacity is expected to exceed 600,000 pieces/month.

Leon Micro: Silicon wafers are small in size, but have the advantage of integrating polished wafers - epitaxial wafers - power devices, with a gross profit margin of over 40%.

NTU Optoelectronics: Deeply cultivated in semiconductor materials, it has successfully independently developed the first domestic ArF photoresist product that has passed customer certification, achieving a major breakthrough in domestic ArF photoresist from zero to one. In terms of business, the original single MO source business structure has been changed, and the MO source and ALD and CVD precursor businesses have been integrated into the advanced precursor business, and three major business segments have been formed with the electronic special gas, photoresist and supporting materials businesses. .

Jacques Technology: The domestic semiconductor material platform giant, its business includes semiconductor chemical materials, electronic special gas, and photoresist. The products cover the core links of semiconductor thin film, lithography, deposition, etching, cleaning and so on. In 2020, the acquisition of LG Chem color photoresist has acquired mature technologies and mass production capabilities such as color photoresist and TFT photoresist, which effectively fills the gap in domestic color photoresist production.

Walter Gas: The 20 kinds of import substitution products developed by the company have achieved large-scale production. Special Gas has also passed the product certification of ASML, the world's largest lithography machine supplier, and supplies first-line companies such as SMIC and Huahong Grace.

Red Avenue New Materials:Beijing Kehua Holdings Co., Ltd. entered the semiconductor photoresist market. Beijing Kehua is the only Chinese photoresist company listed in the top eight photoresist companies in the world. It is also the photoresist company with the highest sales in China, and has entered domestic manufacturers such as SMIC, Yangtze River Storage, and Hua Hong Semiconductor.

Anji Technology: The leading domestic polishing liquid, with a domestic market share of more than 20%, second only to Cabot.

Dinglong Co., Ltd.: The leading domestic polishing pad has become a supplier of Changjiang Storage, and it has also continued to increase its volume to SMIC.

Jianghua Micro: The leader of domestic wet electronic chemicals, breaking the restriction barriers of foreign companies, and gradually realizing the localization of the low-end market. Its ultra-clean and high-purity reagents and photoresist supporting reagent products have the ability to provide a full range of wet electronic chemicals for flat panel display, semiconductor, photovoltaic and other fields.

Jiangfeng Electronics: The leader in the domestic high-purity sputtering target industry, extending the horizontal and vertical industrial chain. At present, tantalum, copper, titanium, and aluminum targets for 90-7nm semiconductor chips can be mass-produced. Among them, tantalum targets have been mass-produced in [敏感词]'s 7nm chips, and 5nm technology node products have also entered the verification stage.

07

Semiconductor Equipment

[1]Industry status, overview and localization

In addition to materials, the operation of the semiconductor industry chain also requires the support of semiconductor equipment.

Semiconductor equipment mainly includes nine types of silicon wafer equipment, heat treatment equipment, lithography equipment, etching equipment, ion implantation equipment, thin film deposition equipment, polishing equipment, cleaning equipment, and testing equipment. Its total investment accounts for about 75-80% of the fab construction investment, and most of the equipment has quite high technical barriers, which is almost the most critical area in my country's road to realizing the independent and controllable semiconductor industry chain.

In 2020, the localization rate of semiconductor equipment in my country is only 16%, and NAURA, the semiconductor equipment company with the largest revenue volume, accounts for less than 1% of the global equipment share. There is a long way to go.

Among them, the lithography machine is the equipment with the highest technical barriers in the semiconductor production equipment. Each one requires hundreds of days of polishing. Its function lithography is the core link of wafer manufacturing. The designed circuit diagram is transferred from the lithography plate to the It is printed on the photoresist on the surface of the wafer, which is convenient for subsequent design circuits through etching and ion implantation. Therefore, the Dutch company ASML, which has a monopoly in the field of lithography machines, plays a pivotal role in the global semiconductor industry. Last year, it only sold 258 lithography machines, but its revenue was as high as more than 100 billion. The real money is hard to find.

If our country wants to produce independently, it is not just about the lithography machine, but also involves thousands of suppliers. Now the equipment and materials for making it are mainly provided by the United States, Germany, Japan, and [敏感词], China, and the United States is the main problem, so it is said It is necessary to build a huge industrial chain and lead in so many high-tech fields to get a lithography machine. The reason why it is difficult for SMIC to make progress in advanced manufacturing processes is the decisive role of the United States' obstruction of SMIC's purchase of ASML EUV lithography machines.

[2] Brief analysis of leading companies

North Huachuang: The absolute leader of domestic semiconductor equipment, with strong platform attributes. It has been deeply involved in the fields of chip manufacturing, etching and thin film deposition for nearly 20 years, and has become a leading supplier of high-end semiconductor process equipment and one-stop solutions in China, with customers covering SMIC, Hua Hong, Sanan Optoelectronics, BOE and other industrial chains faucet.

China Micro Corporation: Double leader of domestic dielectric etching equipment and MOCVD equipment, implementing epitaxial development strategy, dielectric etching machine has entered 5nm process, and the technology is close to world-class level.

Precision Electronics: The leader of testing equipment, to achieve full coverage of equipment in the field of semiconductor testing. In the three major fields of semiconductor film thickness, memory and driver IC, it is expected to usher in the second wave of golden growth in the future with the heavy volume of semiconductor equipment business.

Huafeng Measurement and Control:The leader of testing machine equipment, the products have expanded from analog and mixed-signal testing equipment to SoC testing. The technology is close to the world-class level, and it has entered the leading supply chain of packaging and testing, with a gross profit of 80%.

Jingsheng Electromechanical: It is a leader in domestic crystalline silicon growth equipment, and has the largest domestic high-end market share. It has mature layouts in four fields including photovoltaics, semiconductor wafers, sapphire, and SiC. At the same time, the company has also extended to the post-growth processing stages such as cutting, grinding, polishing, and epitaxy, and has grown into a leader in integrated crystal manufacturing equipment.

Xinyuan Micro: The leader of domestic high-end glue coating and developing equipment, successfully breaking the monopoly of foreign manufacturers, it is the only company in China that can provide middle and high-end glue and developing equipment, and its downstream customers cover most of the domestic LED chips Manufacturing companies and high-end packaging companies.

Disclaimer: This article is reproduced from "Shi Talking", this article only represents the author's personal views, not the views of Saco Micro and the industry, only for reprinting and sharing, Support the protection of intellectual property rights, please indicate the original source and author for reprinting. If there is any infringement, please contact us to delete it.

Site Map | 萨科微 | 金航标 | Slkor | Kinghelm

RU | FR | DE | IT | ES | PT | JA | KO | AR | TR | TH | MS | VI | MG | FA | ZH-TW | HR | BG | SD| GD | SN | SM | PS | LB | KY | KU | HAW | CO | AM | UZ | TG | SU | ST | ML | KK | NY | ZU | YO | TE | TA | SO| PA| NE | MN | MI | LA | LO | KM | KN

| JW | IG | HMN | HA | EO | CEB | BS | BN | UR | HT | KA | EU | AZ | HY | YI |MK | IS | BE | CY | GA | SW | SV | AF | FA | TR | TH | MT | HU | GL | ET | NL | DA | CS | FI | EL | HI | NO | PL | RO | CA | TL | IW | LV | ID | LT | SR | SQ | SL | UK

Copyright ©2015-2025 Shenzhen Slkor Micro Semicon Co., Ltd