Service hotline

+86 0755-83044319

release time:2022-03-17Author source:SlkorBrowse:11997

The continuous maturity of underlying technologies such as 5G, artificial intelligence, networking technology, and new energy drives the continuous development of electrification and intelligence in downstream applications, thereby continuing to promote the steady growth of the global semiconductor industry. It is estimated that by 2025, the global semiconductor industry market size will reach 630 billion US dollars. With the advancement of technology, various fields such as consumer electronics, communications, automobiles, and industry will usher in industry transformation, further expanding the total demand for semiconductors.

With digital transformation and the establishment of the "dual carbon" goal, as well as the normalization of the epidemic and the entry of the semiconductor industry into the post-Moore era, what changes will this series of changes bring to the semiconductor industry? What are the current technological trends in the industry and changes in the needs of chip design developers? With these questions in mind, Jiwei.com was honored to invite Synopsys Global Senior Vice President and China Chairman Mr. Ge Qun to look for China through the perspective of a digital transformation root technology provider. The future trajectory of the semiconductor industry.

Mr. Ge Qun, Global Senior Vice President of Synopsys and Chairman of China

First question: Does digital transformation break the cyclical development of the semiconductor industry?

The impact of the epidemic on the global chip supply chain is obvious. Due to the different degrees of recovery from the epidemic in various countries and regions, supply-side production capacity is constrained to varying degrees. At the same time, the outbreak of the epidemic has stimulated and accelerated the development of global digitalization, leading to the peak of chip manufacturing capacity. In the face of strong demand, the imbalance between supply and demand has caused a demand gap. In a report released in the second quarter of this year, Gartner pointed out that the global semiconductor inventory index was less than 0.9, indicating that the global market was in a period of severe shortage of semiconductors.

Synopsys Global Senior Vice President and China Chairman Ge Qun pointed out that, in fact, the semiconductor industry has been showing a strong cyclical development pattern for the past few decades. "Although the industry has already begun to discuss when the apex of this semiconductor cycle will occur and when the core shortage caused by the shortage of capacity can be alleviated, I believe that with the digital transformation bringing greater Rigid demand for semiconductors and 'lack of cores' may be an inescapable topic in the next five years.”

Ge Qun said that the process of digitalization can not only reshape the industrial logic and economic form, but also further unleash the vitality of technological innovation and open up new economic growth points. The status of the digital economy-related industries born from this is expected to be further improved. Artificial intelligence, 5G communication, cloud computing, metaverse and other fields will receive sufficient policy support. Technological progress and rapid industry growth will provide a huge stage for talents. It also provides a high-quality investment track and valuable investment opportunities for the capital market.

"Digital transformation is the process of projecting the real physical world into the digital world. In the future, traditional industries that have existed for decades or hundreds of years will be integrated into digital technology and then optimized, ultimately making production efficiency and productivity higher. Make the industry larger.The digital transformation of traditional industries is the core of China's industrial upgrading, and China is undoubtedly at the forefront of the world in this regard." He pointed out, " In the early stage of the digital transformation process, there will be pains, there will be many technical challenges, there will also be discomfort, and the development of the ecological chain will also be unbalanced. As the cornerstone of supporting the growth of the digital economy, the importance of chips is self-evident. The digital economy has also brought more market demand for chips.”

Ge Qun explained that if a digital task is simply described, it includes perception-transmission-cloud/edge processing-communication task-to-end-end-to-end control action. In the perception link, a large number of sensors of various types are required; in the transmission link, emerging network connection technologies such as WiFi, Bluetooth, 5G/6G, and even Starlink are required; in the calculation and processing links, various For CPU, GPU, DPU, memory, etc. with powerful computing power or energy saving, if the data generated in this link is further mined, various AI inference, training and acceleration chips are required; after the final data processing is completed, it must be sent through communication. To perform operations on the terminal, to reflect or guide human life, various precise controllers are needed. “So in the digital economy era, every link of people’s production and life is inseparable from chips, which will create exponential market capacity for the chip industry.”

Under the wave of digitalization, whether it is the manufacture of living materials or the electrification of automobiles, the entire society has been unable to return to a state where it can operate without chips. The trend of digitalization has changed the structure of society, and the explosion point has not yet come, so he believes that this foreseeable and larger demand will change the cyclical fluctuations of the semiconductor industry in the past few decades, and in recent times around the world The newly built chip manufacturing capacity will take 2 to 3 years to be put into mass production, so it is expected that the demand for chips will not be fully satisfied within 5 years.

Second question: Entrepreneurship + cross-border chip making, who will master future chip design?

The increasingly large and diverse application requirements have promoted the vigorous development of the chip industry. Market research firm IBS predicts that the scale of the global integrated circuit industry will exceed US$1 trillion in 2030, 2.6 times that of 2020. This estimate is still conservative and does not take into account the new demand brought about by the great digital leap forward. Chip design startups have sprung up like mushrooms after a rain, and various Internet, automobile, mobile phone and other system manufacturers have also entered the ranks of "creating chips".

Ge Qun shared the 2021 survey report at the recent Synopsys developer conference, pointing out that the market and capital are most concerned about the six chip startup tracks, including automotive MCU, autonomous driving ADAS, GPU, WiFi 5/6, DPU, AIoT. In addition, with the growth of Internet, mobile phone, automobile and other system manufacturers and the increasingly fierce competition, more and more companies have embarked on the self-developed "chip making" "the way.

"China is the only country in the world that has all the industrial categories listed in the United Nations Industrial Classification, and has the strongest system capabilities. Supported by the largest market demand and system capabilities, in the past, based on existing chip functions, The way to design the terminal system has changed to define the function of the chip according to the requirements of the terminal system. When this demand is becoming more and more unsatisfactory, many system and Internet companies have embarked on the road of self-developed chips.” Ge Qun said, "The logic behind it is the demand for differentiation, which prompts system manufacturers to consolidate their ability to grasp the terminal market by implementing their own chips."

Whether it is a chip entrepreneur or a cross-border core maker, the time to market is the biggest challenge for chip developers. At the same time, with the evolution of chip manufacturing process and the change of system-level architecture, the scale and complexity of chip design have increased geometrically. Ge Qun pointed out that as the cornerstone of chip design, EDA and IP providers such as Synopsys will play an increasingly important role in this transition.

“For example, the solution launched by Synopsys is to abstract the chip design ideas, and combine the underlying details and experience into tools to form a design methodology. Chip design engineers can use high-level hardware description languages to write codes to realize chip functions. After functional verification, the hardware description language is converted into a logic circuit diagram through a logic synthesis tool, and finally enters the manufacturing process. This greatly improves the efficiency of chip design and triggers a process change in the chip design industry." He said, "Synopsys has been leading the tool innovation of chip design from abstract description to concrete practice. In the future, it will further improve the abstraction level of chip design, describe systems and chips in higher-level languages, and then turn them into chips to solve system-level problems. This is our concept of 'SysMoore' to think about the design methodologies to solve the challenges of the semiconductor industry from a higher dimension."

The goal of Synopsys is to, on the one hand, solve the modeling and abstraction problems of different processes, especially silicon processes, by integrating design tools and chip life cycle management platforms, so that humans can make better use of different processes, especially Advanced technology for innovation. On the other hand, make full use of AI, cloud, big data and other technologies to make EDA algorithms more powerful, enhance EDA performance, lower the threshold of chip design, and allow more people to participate in chip design.

Then the question is, under the new demand, who will lead the chip design in the future, system manufacturers, chip manufacturers and EDA manufacturers?

In this regard, Ge Qun believes that the advantage of system manufacturers is that they have a good understanding of their own terminals and customer needs, but their understanding of many chip architectures/microarchitectures is not as good as that of traditional chip companies, and they are not familiar with how To run a chip design company efficiently. "There is a huge difference between the habits and logic of system companies' product development and chip development. For example, system companies' terminal products have a fast update cycle and need to be listed as soon as possible. If the software has bugs, it may be debugged overnight. It takes about 18 months to be produced." He pointed out, "In the past few years, there have been system companies and software companies trying to make chips in China. The biggest challenge they face is facing many chip architectures, they don't know how to realize their own requirements, which is the most suitable and which manufacturing process is most suitable.”

The advantage of a chip design company is the understanding of the chip architecture, and the ability to make the chip according to the time window with the appropriate technology and the optimal cost, but the lack of in-depth system and terminal applications learn. Chip design companies need to find good system companies to cooperate with and dig deeper into the needs to provide flexible general-purpose chips that can adapt to multiple end applications.

For these two types of customers, Synopsys provides completely different services. Ge Qun said that for system manufacturers, the goal is to help them solve the choice of chip architecture and process through various IP modules and design tools; for chip companies, the goal is to be faster and easier to use through simulation verification, rapid prototyping, etc. It can simulate the actual performance, power consumption and other performances before the chip is produced, saving cost and design cycle. “In a sense, the goal of EDA is to accumulate and digitize previous chip design experience so that past experience can be reused quickly and efficiently into future chip designs. The concept of technology DSO.ai, it is the first solution in the industry to help customers design chips with an autonomous AI system. Fusion design + DSO.ai can help customers design and develop chips with AI systems and achieve the best results , the design process and time-to-market are also the fastest.”

In addition, these two types of customers are also completely new areas in terms of resources and support for industrial chains such as fabs. In this regard, Ge Qun emphasized that Synopsys has been committed to becoming a larger and larger industrial chain partner, and through the power of the "circle of friends", every system scenario and every detail needs of customers can be met. "The advantage of Synopsys is that it can promote the whole process optimization from the bottom-level process optimization, chip optimization to software optimization, so as to achieve higher-level optimization and higher-level abstraction. We have many Partners may have been deeply involved in a certain segment for many years, but lack the most complete tool chain like Synopsys; Synopsys also found that some local EDA companies are very bright in some point tools, so Synopsys is also very active in cooperating with the upstream and downstream of the local industry chain, and even with peers, with the goal of providing customers with better and more complete tools and services."

For example, in the cooperation between Synopsys and Xinhe Semiconductor in the field of advanced packaging, after customers use Synopsys' design tools to export the chip layout data, they can directly import them into Xinhe's packaging design tools for further design. No need to iterate over the data again. "This is a good example of cooperation, allowing our Chinese customers to enjoy the chip and the most advanced 2.5D/3D-based package design and analysis tools without changing the current ecological workflow." He emphasized, "The partners selected by Synopsys in the Chinese industrial chain can complement each other very well. Our cooperation is not a slogan, but a real way to enable mutual customers of both parties to enjoy the value and benefits brought by cooperation.< /strong>”

The third question: Can domestic EDA learn from the development experience of Synopsys?

Recently, there has been a rapid increase in the number of EDA companies in China, and the number of financing cases has increased in parallel. According to incomplete statistics, there were 64 domestic EDA enterprises by the end of June, and the financing activities were also very frequent under the enthusiasm of capital, and the financing scale was larger. Under the inclination of capital and policies, some companies that have only been established for 1-2 years intend to grow rapidly through the shortcut of mergers and acquisitions. There are many hidden worries under the surface prosperity. So, can domestic EDA manufacturers learn from the development experience of Synopsys?

Ge Qun pointed out that what we can learn from is the underlying logic of "long-termism" that has always been adhered to in the development of Synopsys.

He emphasized that, first of all, we must pay attention to personnel training. EDA is the source of technological innovation and the root technology of the integrated circuit industry. The innovation of EDA technology itself is particularly important, but the current situation of the EDA talent market is not optimistic, and the EDA talent training cycle often takes ten years from university research to actual practice. Innovation needs attention. Synopsys attaches great importance to talent training and the construction of talent ladders, with an annual R&D investment of 30%+, including detailed talent training plans, the establishment of joint laboratories, training centers and Synopsys think tanks, and international conferences and overseas training. , and cooperate with colleges and universities to carry out curriculum adaptation, etc.

Second, continuous research and development and respect for the development law of the semiconductor industry. EDA companies should respect the development law of the semiconductor industry and continue to invest in research and development. In the process of research and development, it is necessary to pay attention to all-round cooperation with downstream leading chip design companies, fabs and even packaging and testing manufacturers, so that EDA companies can learn the latest process-related information and data at the first time, so as to update EDA and IP products to meet the needs of The latest needs of downstream customers. Synopsys has been maintaining cooperative relations with the world's leading industrial chain companies such as [敏感词], Intel, Samsung, and Arm for nearly 30 years, and has continued to develop IP products suitable for the most advanced processes. However, Ge Qun emphasized that maintaining investment in cutting-edge technology will inevitably involve risks. Not every investment will be successful, but this is the only way for the company to become a leader.

Third, we must establish a customer-oriented concept and empower customers to succeed in all aspects. Since entering China for 26 years, Synopsys has always adhered to the concept of growing together with China's semiconductor industry, and provided corresponding technical support based on the development of the local market and industrial needs. Adjust the direction and strategy in time in different periods and stages, so as to always focus on the needs of customers. For example, after 20 years of development, China's semiconductor industry has entered a new period of development, and the role of capital in promoting technology and industry has gradually become prominent. Therefore, Synopsys began to set up a new strategic investment fund in China. As a fund of funds, it not only supported chip technology and the latest technological innovations in capital, but also capitalized on the support of Synopsys by cooperating with local Chinese enterprises and investment institutions. Power empowers innovative enterprises to grow rapidly.

Fourth, the prerequisite for M&A growth is that its own products and market capabilities are strong enough. Due to the high technical requirements of EDA tools and many links involved, so far no local company has covered the whole process. It is true that the development history of EDA is a history of mergers and acquisitions, but only relying on capital acquisitions cannot effectively solve the problem of relatively shallow technology accumulation in the local EDA industry. Ge Qun emphasized that Synopsys is about to celebrate its 35th anniversary, but most of the company's mergers and acquisitions occurred 10 years after Synopsys was established. He pointed out, "We believe that China's huge market will give birth to excellent EDA companies, but the growth depends on the company's solid technology and product foundation, and the trust and recognition of local customers can be obtained first. ability to digest and acquire.”

Conclusion

Ge Qun emphasized that the market opportunities and technical challenges brought about by digitization coexist, and the semiconductor industry chain may face various uncertainties at any time, but he believes that "chip people" have enough resilience to adapt to such a highly dynamic market and Industry changes. "As an important part of China's semiconductor industry, Synopsys aims to provide more complete and smarter tools for the Chinese industry." He proposed "+ Synopsys" to advocate the establishment of a community with a shared future for the chip industry. "This Synopsys is a pun, not necessarily with Synopsys' tools, but more hope that all partners and customers can have more new technologies, new ideas, new ideas, and hope that China's semiconductor industry family Get higher quality and higher speed development with the help of 'New Thinking'." (Proofreading/Sami)

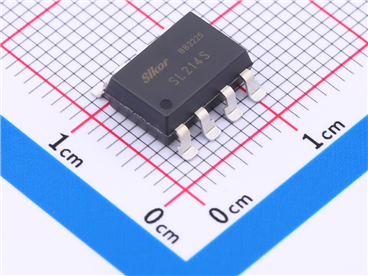

Disclaimer: This article is reproduced from "Lechuan". This article only represents the author's personal views, not the views of Saco Micro and the industry. It is only for reprinting and sharing, and supports the protection of intellectual property rights. Please indicate the original source and author for reprinting. If there is any infringement Please contact us to remove.

Site Map | 萨科微 | 金航标 | Slkor | Kinghelm

RU | FR | DE | IT | ES | PT | JA | KO | AR | TR | TH | MS | VI | MG | FA | ZH-TW | HR | BG | SD| GD | SN | SM | PS | LB | KY | KU | HAW | CO | AM | UZ | TG | SU | ST | ML | KK | NY | ZU | YO | TE | TA | SO| PA| NE | MN | MI | LA | LO | KM | KN

| JW | IG | HMN | HA | EO | CEB | BS | BN | UR | HT | KA | EU | AZ | HY | YI |MK | IS | BE | CY | GA | SW | SV | AF | FA | TR | TH | MT | HU | GL | ET | NL | DA | CS | FI | EL | HI | NO | PL | RO | CA | TL | IW | LV | ID | LT | SR | SQ | SL | UK

Copyright ©2015-2025 Shenzhen Slkor Micro Semicon Co., Ltd