Service hotline

+86 0755-83044319

release time:2022-03-17Author source:SlkorBrowse:12705

Qorvo, a leading provider of radio frequency solutions, announced today that it has acquired Princeton, NJ-based United SiliconCarbide (UnitedSiC), a leading manufacturer of silicon carbide (SiC) power semiconductors. According to reports, the acquisition of United Silicon Carbide expands Qorvo's reach into the fast-growing electric vehicle (EV), industrial power, circuit protection, renewable energy and data center power markets. Following the acquisition, UnitedSilicon Carbide will reportedly become part of Qorvo's Infrastructure and [敏感词] Products (IDP) business, led by Dr. Chris Dries, formerly President and CEO of United Silicon Carbide and now Qorvo Power Devices Solutions General Manager of the Program.

"The addition of UnitedSiC to our IDP business unit significantly expands our market opportunities in high power applications," said Philip Chesley, president of Qorvo IDP. "This acquisition enables Qorvo to provide high value, best-in-class smart power solutions covering power conversion, Motion control and circuit protection applications.”

"As part of Qorvo, our team is excited to expand our SiC product portfolio and continue to build our business at speed and scale in an effort to accelerate SiC adoption with the industry's highest performance devices," said Dr. Dries. Our SiC technology, coupled with Qorvo's complementary programmable power management products and world-class supply chain capabilities allow us to deliver exceptional levels of power efficiency in advanced applications."

United Silicon Carbide's product portfolio now includes more than 80 SiC FET, JFET and Schottky diode devices. Based on a unique cascode configuration, the recently released Gen 4 SiC FETs are rated at an industry-leading 750V and 5.9 milliohm RDS(on), enabling applications from EV chargers, DC-DC converters and traction drives to New levels of critical SiC efficiency and performance, as well as telecom/server power supplies, variable speed motor drives and solar photovoltaic (PV) inverters.

Qorvo launches multiple acquisitions, laying out the future

Qorvo, a new company formed by the merger of RFMD and TriQuint in 2015, is a well-deserved giant in the RF market.

Official information shows that Qorvo, which RFMD and TriQuint merged to form that year, combined their complementary product portfolios, especially power amplifier amplifiers (PAs), power management integrated circuits (PMICs), antenna control solutions, switch-based products and high-quality filtering. Qorvo also uses these products to deliver the industry's most comprehensive portfolio of high-performance mobile device solutions to customers. It is also because of this merger that the new Qorvo has the ability to improve the quality of service provided by the infrastructure and [敏感词]/space industries, and to provide advanced gallium nitride (GaN) solutions for other markets and applications.

And the above is exactly what Qorvo has prepared for the rapidly developing 5G market.

In fact, in addition to the above businesses, the extensive demand for [敏感词], WiFi 6 and the Internet of Things has also brought a non-negligible contribution to Qorvo's performance. In order to enhance the company's strength in RF. Qorvo waved the acquisition stick.

In 2016, Qorvo announced the acquisition of GreenPeak, a leading ultra-low power, short-range RF communications technology company. The Netherlands-based company is recognized globally as one of the market leaders in IEEE 802.15.4 and ZigBee, offering a broad portfolio of semiconductor products and software technologies for smart home data communications and the Internet of Things. With this acquisition, Qorvo complements its market-leading high-power RF portfolio with innovative ultra-low power, short-range wireless personal area network (WPAN) SoCs, ZigBee and Bluetooth solutions. Give Qorvo a head start in the IoT market.

In October 2019, Qorvo acquired Cavendish Kinetics, the world's leading provider of high-performance RF MEMS antenna tuning applications. It is understood that since 2015, Qorvo has been a major strategic investor in Cavendish Kinetics, whose RF MEMS devices are used to tune the main and diversity antennas of smartphones in low, mid and high frequency bands, thereby bringing for stronger signals and higher data rates.

"The addition of Cavendish Kinetics allows us to establish market leadership in antenna tuning," said Eric Creviston, president of Qorvo Mobile Products. Several of the world's leading smartphone suppliers have achieved significant improvements in antenna performance by using CK's RF MEMS technology to reduce losses and improve linearity. CK has optimized and expanded the technology for other applications such as infrastructure and [敏感词], and Qorvo will build on the excellent work CK has done. "

Last year, Qorvo completed the acquisition of CustomMMIC. The addition of a major player in RF and microwave MMICs with extensive experience developing MMICs up to 70 Ghz also strengthens Qorvo's GaAs and GaN RF products for [敏感词] and aerospace. strength.

With these acquisitions, Qorvo has strengthened the company's position in the RF industry while the market has changed.

is the cornerstone of Qorvo, that's for sure. But as an enterprise with deep technical accumulation and keen insight. In addition to RF, Qorvo has seen new growth opportunities for the company, and has been involved in it. The Internet of Things is the most important one. The aforementioned acquisition of GreenPeak Technologies is Qorvo's first big bet in this market. With this deal, they want to cut into the IoT connectivity market.

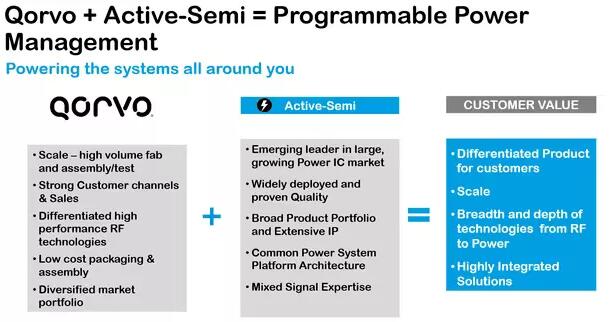

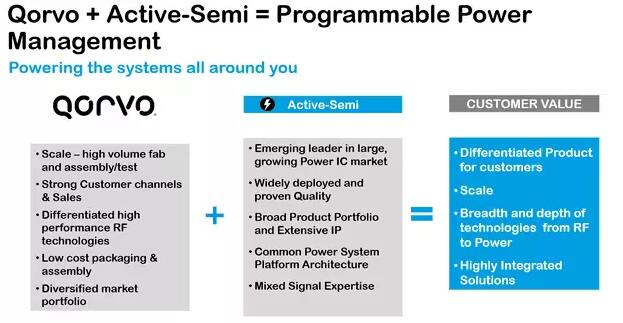

The year before, they acquired another company called Active-Semi. One target of the deal is the power supply market for IoT devices.

According to data, Active-Semi, founded in Silicon Valley, is a rapidly emerging leader in the power management and smart motor driver integrated chip (IC) market. The company's portfolio of analog and mixed-signal SoCs provides scalable core platforms for charging systems, power delivery systems and embedded digital control systems for industrial, commercial and consumer applications. In particular, the PACs and programmable analog ICs it provides can greatly reduce solution size and cost, improve system reliability, and shorten system development time. The support it brings to the burgeoning market of smart home devices, an application offshoot of the Internet of Things, is obvious.

But that's just the tip of the iceberg of Active-Semi's "treasure trove."

Through the acquisition of Active-Semi, Qorvo will increase its IDP offering to existing customers, including 5G base stations, [敏感词] active phased arrays, automotive and IoT, and expand its offerings to existing customers, according to Bob Bruggeworth, Qorvo President and CEO. Business scope expanded into new high-growth power management markets. Qorvo believes that by leveraging the company's global scale, sales channels and customer relationships to accelerate adoption of Active-Semi's innovative analog/mixed-signal solutions in multiple markets, we will have significant opportunities. "

From his introduction, we learned that Qorvo brought Active-Semi under its command. In addition to the Internet of Things, it also saw the opportunities it brought to the 5G, industrial, data center and automotive markets. Taking 5G as an example, the new system not only brings RF requirements, but also faces unprecedented new challenges in terms of base station power supply, which is what Active-Semi is committed to solving.

As for the specific approach, Qorvo said that if power management, PAC and RF can be effectively combined, and power can be used to give RF life, it can provide the industry with more efficient and higher-quality solutions. Of course, Qorvo's extensive customer base will also be an important reliance for the company to expand into new businesses.

After completing the acquisition of analog and mixed-signal SoC suppliers, Qorvo continued to announce its acquisition of Decawave last year. This is mainly about the UWB chip market introduced by Apple in the new generation of flagship smartphones. The so-called UWB, which is Ultra Wideband (Chinese Ultra Wideband), is actually not a new thing. As early as 1960, the concept of UWB was proposed, and in 1973, the patent for the first UWB system has also been granted.

As a non-traditional communication system, UWB uses nanosecond non-sinusoidal narrow pulses to transmit data for information carriers, which enables it to have high positioning accuracy, strong security and anti-interference, high transmission green space, and multi-path resolution. High rate and good system confidentiality.

It is precisely because of its many advantages that UWB is regarded as the preferred choice for smart home, augmented reality and indoor navigation. After Apple entered this market, the industry's attention was even higher than ever. And Qorvo also took a fancy to this business opportunity and acquired Decawave, the leader in the UWB chip industry.

According to Qorvo, Decawave is an industry pioneer in ultra-wideband (UWB) technology and a provider of UWB solutions for mobile, automotive and IoT applications. From its founding in 2007 to its acquisition by Qorvo this year, Decawave has deployed more than 8 million chipsets in more than 40 different vertical markets, from smartphones to drones. The company's pulsed radio UWB technology enables positioning services accurate to a few centimeters with extremely low latency, making it an important partner for customers entering this market. In Qorvo's view, based on the groundbreaking work of the Decawave team, coupled with Qorvo's own RF front-end experience and large customer base, the combination of the two can embrace UWB to mobile, automotive, industrial and consumer IoT The huge new opportunities brought about by the expansion of new markets such as the field.

Judging from the development trend of the integrated circuit industry in the past few years, acquisitions are undoubtedly an effective way to quickly enter a new track. Because unlike the past, the terminal market is developing rapidly and changing rapidly. For the relevant suppliers, if they cannot quickly occupy a priority position on the track, they may be washed to the beach by the back waves at any time.

As a business that also has extensive experience in this area, Qorvo has stockpiled enough "ammunition" for the future. With today's acquisition, Qorvo has further expanded its reach.

Disclaimer: This article is reproduced from "Semiconductor Industry Observation". This article only represents the author's personal opinion, not the opinion of Sacco Micro and the industry. It is only for reprinting and sharing, and supports the protection of intellectual property rights. Please indicate the original source and author for reprinting. , if there is any infringement, please contact us to delete it.

Site Map | 萨科微 | 金航标 | Slkor | Kinghelm

RU | FR | DE | IT | ES | PT | JA | KO | AR | TR | TH | MS | VI | MG | FA | ZH-TW | HR | BG | SD| GD | SN | SM | PS | LB | KY | KU | HAW | CO | AM | UZ | TG | SU | ST | ML | KK | NY | ZU | YO | TE | TA | SO| PA| NE | MN | MI | LA | LO | KM | KN

| JW | IG | HMN | HA | EO | CEB | BS | BN | UR | HT | KA | EU | AZ | HY | YI |MK | IS | BE | CY | GA | SW | SV | AF | FA | TR | TH | MT | HU | GL | ET | NL | DA | CS | FI | EL | HI | NO | PL | RO | CA | TL | IW | LV | ID | LT | SR | SQ | SL | UK

Copyright ©2015-2025 Shenzhen Slkor Micro Semicon Co., Ltd