Service hotline

+86 0755-83044319

release time:2022-03-17Author source:SlkorBrowse:11700

With the advent of the 5G era, the power requirements of mobile phones are getting higher and higher, which leads to higher and higher battery usage of more powerful phones, and more and more mobile phones are used by games and streaming.

Mobile phone manufacturers have made great innovations in terms of size, display screen, and camera performance. While functions and performance have been improved, power consumption has also increased. The common problem of charging once a day is hard to fix, and battery life has long affected user experience. Increasing battery capacity cannot completely solve the problem of battery life, and shorter charging time has become one of the directions for mobile phone improvement.

Legend: Jefferay Lawton, Product Marketing Manager, ON Semiconductor

In 2019, mobile phone manufacturers such as China's top technology enterprise, Xiaomi, OPPO, and VIVO have begun to standardize high-power fast chargers, and related power devices, main control, drivers, protocol chips, power management, and even passive devices have begun to be put forward accordingly. new requirements. On September 15, Apple released the new Apple Watch. From the information displayed on the official website, the new Apple Watch continues to come with a 1-meter magnetic charging cable, but the 5W power adapter that was previously included is not included in the box. Think of industry rumors - the upcoming new iPhone will also cancel the standard power adapter.

The cancellation of the standard power adapter for Apple products may bring huge opportunities to the charging head industry. According to research firm Omdia, Apple shipped an estimated 37.7 million iPhone 11 smartphones worldwide in the first half of 2020, 26 million more than its next-best competitor. If the new iPhone cancels the standard power adapter, tens of millions of power adapter needs will be released to third-party power adapter manufacturers.

Jeffrey Lawton, product marketing manager of ON Semiconductor, said the fast-charging market is developing rapidly, dominated by mobile phone makers in Asia and third-party repair parts market players. The market has more than doubled in 2020. He expects standard phone chargers to triple or quadruple the power, ranging from 15W to 50 or 60W, with some phones designed to support charging in excess of 100W for short periods of time. "In the past, third-party manufacturers dominated high-power chargers, especially by offering chargers with multiple USB outputs. As phone makers release 5G-enabled phones, we'll see them offer more high-power Chargers," said Jeffrey Lawton.

According to estimates by Yi Changgen, CEO of Chengdu Silicon Power Technology Co., Ltd., there are hundreds of charger manufacturers of major domestic brands and thousands of small manufacturers, most of which are located in Shenzhen. Covering brand manufacturers to foundry factories, and the industry chain is complete. From the perspective of demand, consumer products including mobile phones, tablets, notebooks, and small home appliances all use chargers, and the market is relatively large. In addition, he believes that the interface of future charger products will move closer to Type C. Type C is a standardized interface, which is small in size and can be connected in both directions. Type C equipped with USB PD protocol has been implemented in 100W commercial products.

Yi Changgen, CEO of Chengdu Silicon Power Technology Co., Ltd. believes that because high-power fast charging has many advantages, the market development is unstoppable. Today's high-power fast charging is not just about providing electricity. Fast charging products are more appropriate - not only fast charging, but also intelligent.

Simply put, the same charger has the ability to charge consumer terminals such as mobile phones, tablets, and computers. For example, when connecting a mobile phone, the mobile phone sends instructions to the charger, and after the two ends "handshake", it provides reasonable power, voltage and current; similarly, when connecting a tablet or laptop, it will also provide corresponding charging power according to the instructions. This is equivalent to a charger with several interfaces, and a charger is suitable for different terminal devices.

Note: Yi Changgen, CEO of Chengdu Silicon Power

The demand of a large number of fast-charging manufacturers has also led to the vigorous development of fast-charging chips. There are cost considerations behind Apple's cancellation of the standard charger, which can be said to be an embarrassing and wise choice. While the cost of the whole machine is reduced, it also simplifies the packaging and is more environmentally friendly. On the other hand, it also reflects the high cost of high-power fast charging, which leads to high prices of end products. The cost factor is also a problem that players who enter the high-power fast charging market have to consider.

At present, there are many manufacturers entering the high-power fast charging market. Lin Chengwen, business manager of Jianbo Microelectronics (Shenzhen) Co., Ltd., said that under the premise of ensuring product quality, in order to stand out, it depends on product cost. Among the high-power fast charging products of different manufacturers, manufacturers try their best to make efforts in product compatibility, flexibility, and ease of use, but in the end, they must control the cost of products to obtain acceptable and competitive prices for consumers.

Legend: Lin Chengwen, Business Manager of Jianbo Microelectronics (Shenzhen) Co., Ltd.

In addition to price, product compatibility is also the key to consumer experience. According to reports, Jianbo Micro has developed a PD-compatible fast charging chip with a power of up to 100W, which has been tape-out and is expected to be launched in the second half of the year.

Chengdu Silicon Power Technology Co., Ltd. was founded in San Jose, Silicon Valley, USA in 2017. It was officially established in Chengdu, China in November 2019. The founders are all from famous American semiconductor companies. The company focuses on three aspects of chip R&D and sales: First, positioning high-end intelligent power management chips, filling the domestic gap, perfecting the goal of replacing high-end chips in the United States, breaking the monopoly of the American market, and cracking some restricted chips in the trade war. Second, locate low-power power management chips to provide chips with higher reliability and ultra-long standby for various portable electronic products. Third, locate Type C and PD fast charging chips, and design a series of PD chips such as PWM-controlled AC-DC, synchronous rectification SR, 100% duty cycle DC-DC, and PD full-compatible protocols around PD fast charging.

It is reported that Silicon Power has been recognized by many major customers. For example, the cooperation with Xiaomi and Baseus is in the sample delivery stage, and it has successfully entered the supply chain of mainstream charger terminal brands. In order to expand product applications, its subsidiary Ivan Microelectronics provides customers with technical support and solution development services.

Under the advertising offensive of mobile phone manufacturers, the concept of fast charging has been widely known. In the era of feature phones, linear charging chips can meet the current charging requirements of 800mA to 1A. In the 3G/4G era, the disadvantages of low conversion efficiency and temperature rise of linear charging chips have emerged. Switching charging has gradually replaced linear charging and has become the mainstream. Switch charging chips have gradually expanded from mobile phones to consumer electronic products such as TWS earphones, electronic cigarettes, and voice recorders.

Legend: Ou Xinhua, General Manager of Shanghai Xinyong Electronic Technology Co., Ltd.

According to Ou Xinhua, general manager of Shanghai Xinyong Electronic Technology Co., Ltd., Xindao developed a switching charging chip as early as 2016, with an efficiency of 92-95%, which is the main power chip for fast charging. Driven by the trend of high-power charging, mobile phones need larger charging current. A mobile phone tends to use two or three switching charging chips. For example, a mobile phone with a 120W charging specification uses three switching charging chips, each of which carries 40W of power. Coreguide also integrates charging protocols for corresponding products, such as MediaTek fast charging protocol PE1.0/2.0 and Qualcomm's QC2.0.

According to reports, if the current switching charging chips are divided by charging current, the mainstream charging chip products are still 1.5A, 2A, and 3A products, and most charger manufacturers use [敏感词]ese chips, and mainland suppliers in the 1.5A product range have a certain market. Share, 1.5A, 2A switch charging chip has achieved 1-2 US dollars.

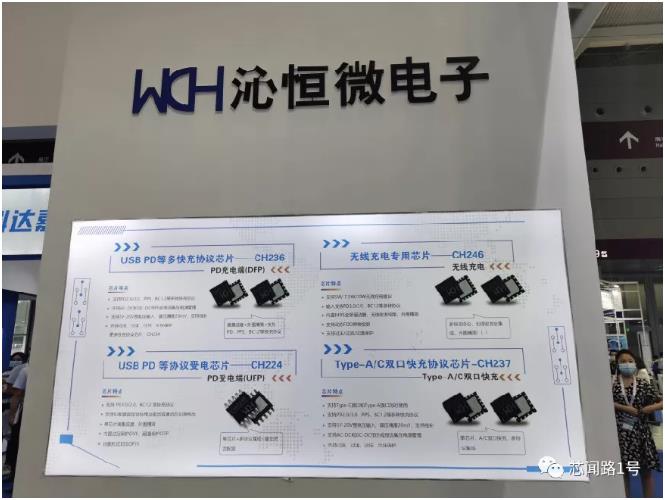

In addition to the manufacturers that are deeply involved in the power supply field, there are also companies that extend into the fast charging field from other fields. Taking the products of Nanjing Qinheng Microelectronics as an example, it first started as a USB interface chip, and finally extended to a USB PC protocol chip. Protocol chips are mainly divided into charging chips and power receiving chips. One feature of the product is that a single chip can integrate multiple fast charging protocols to achieve high compatibility of end products. Typical products include the USB PD multi-fast charging protocol chip CH236 at the charging end, and the USB PD multi-fast charging protocol chip CH224 at the power receiving end. ) multi-protocol chip CH237. Qinhengwei said that the protocol chip on the power receiving end can enable electrical equipment that did not originally support the PD protocol, such as speakers, power tools and other small appliances to support fast charging. At the same time, the PD protocol is suitable for wireless charging, and the small-sized protocol chip helps to improve the integration of terminal products, such as Qinheng Micro CH246. The product features support PD, BC and other protocols, built-in MOS full-bridge driver, wireless transceiver Circuits and peripherals are simplified, thereby reducing the BOM of the end product.

As a 6-year-old company, Yingjixin's compound annual growth rate from 2015 to 2019 was 151%, ranking first in the global market share of the mobile power industry, with a market share of over 60%. In addition to mobile power chips, Yingjixin's products cover five categories: including power management chips, battery management chips, wireless charging SOC, PMU and interface chips. From the release of the first mass-produced chip in 2015 to today, the overall chip shipment has exceeded 1 billion.

At the "10th Songshan Lake China IC Innovation Summit Forum" recently hosted by China Semiconductor Industry Association Integrated Circuit Design Branch and VeriSilicon Microelectronics (Shanghai) Co., Ltd. Peng Feng, Marketing Director of Yingjixin Technology Co., Ltd., introduced its IP5388 high-power fast charging chip.

Legend: Peng Feng, Marketing Director of Yingjixin Technology Co., Ltd.

Peng Feng said that IP5388 is the world's most integrated BUCK/BOOST fast charging chip, with built-in buck-boost controller/power MOS/MCU/TypeC PD PHY, etc. The latest high-power fast charging protocol for major mobile phone brands. It can be widely used in high-power mobile power supply, high-density GaN charger, super fast charging and other fields.

According to reports, the entire BOM periphery of IP5388 is very streamlined, except for some resistors and capacitors, there are only some isolation switching of paths. At the same time, various fast charging protocols are built-in. Seamless iterative upgrades are possible thanks to the built-in MCU. At the same time, it also supports some personalized extensions. For example, some customers will develop their own functions for their own personalized needs. Peng Feng said that there are no more than three mass-produced two-way BUCK/BOOST fast charging chips in mainland China, and Yingjixin is one of them. Fast charging protocol chip suppliers include Cypress, Huinengtai, Tianyu, Yingjixin, Zhirong, Nanxin, Youwei, Weiquan and other manufacturers. Yingjixin's fast charging protocol IC has ranked first in China, and has cooperated with many mobile phone brand chargers such as Xiaomi, OPPO, Samsung Vivo and so on. Peng Feng expressed his hope that it will take another year to become the world's number one.

Designing a fast-charging chip is inseparable from the surrounding discrete devices. According to Jefferay Lawton, product marketing manager at ON Semiconductor, ON Semiconductor provides all major integrated components for high-power fast charging, including power factor correction (PFC) controllers, pulse width modulation (PWM) controllers, synchronous rectifier drivers, USB PD charging Controllers, Optocouplers and MOSFETs. Its latest solutions include NCP1622 PFC controller, NCP1342 quasi-resonant flyback controller, NCP1568 active clamp flyback controller, FUSB3307 USB PD 3.0 charging controller and NCP4306 synchronous rectifier driver. ON Semiconductor is also one of the few suppliers offering everything from diodes to complex resonant PWM controllers for adapter designs.

From a technical point of view, when terminal products are upgraded, what chip suppliers and manufacturers have to do is to subtract chips and reduce peripherals, so that end customers can better and faster integrate chips into terminals. Charger-related components, including rectifier, driver, MOS, etc., will also continue to iterate with the popularity of high-power fast charging. Yi Changgen believes that 100W and 120W are large enough for consumer chargers to meet the power needs of notebook computers and small home appliances, and it is not meaningful to pursue higher power.

When asked if high-power fast charging will go through the development trajectory of knockoff mobile phones, Yi Changgen said that knockoff mobile phones, as a complete product, have mature solutions. One solution can be sold by changing the shell and sticking it with a different brand. There is a public version of the public model scheme, the product homogeneity is obvious, and the downstream manufacturers play more of the role of assembly.

The difference is that high-power fast charging requires manufacturers to have chip and product research and development capabilities, and requires years of technical precipitation. Even if the same components are used, the quality difference of different products still exists. It can be seen that the current specification is also 20W function, and the price span of different products is large. Therefore, the product strategies adopted by high-power fast charging manufacturers are not the same, which cannot be compared with cottage mobile phones.

Jefferay Lawton, product marketing manager of ON Semiconductor, believes that there may be some technical challenges in the development of high-power charging. Primarily the ability to efficiently manage power conversion and improve power density. Current chargers are probably around 15W, jumping to 45W or 100W means delivering 3x to 7x the power. Consumers don't want to see their chargers increase in size by 7 times! Being able to improve energy efficiency and power density means they benefit the most from being able to deliver higher power levels without increasing the size of the charger. This can be achieved through higher switching frequencies and higher integration of more energy efficient power conversion topologies such as high frequency quasi-resonant flyback and active clamp flyback. He said ON Semiconductor is the only semiconductor company offering both topologies in this market space.

In addition, there are various fast charging protocols in the high-power fast charging industry, including USB-PD, Qualcomm QC, OPPO VOOC, China's top technology enterprise SCP/FCP, MediaTek PE, etc. In the past, Apple increased the current of mobile phones to 1A and the current of tablets to 2.4A, and Samsung increased the current to 2A, both powered by 5V. Later, Qualcomm QC 2.0 and QC 3.0 high-voltage charging competed with Oppo's VOOC high-current charging. However, VOOC requires proprietary cables and costs higher. Since Qualcomm didn't open their standard to everyone, Samsung created their own Adaptive Fast Charging (AFC) and China's top technology enterprise created their Fast Charging Protocol (FCP) and Super Charge (SCP). The latter three protocols, AFC, FCP, and SCP, were created with the help of ON Semiconductor and are all over traditional standard A and Micro-B connectors.

Among them, USB PD (full name USB-Power Delivery) is one of the current mainstream fast charging protocols, which can be used for data transmission and high-power charging and discharging. Most fast charging products are compatible with this protocol. The interfaces that support PD are mainly TypeC, but not all TypeC interfaces support the PD charging protocol. The USB PD protocol is not only used for mobile phone charging, but also can be used for mobile power supply to power notebook computers; to connect PC monitors and hosts.

So, will USB PD unify the fast charging standard?

Jefferay Lawton, product marketing manager for ON Semiconductor, believes the answer is yes. As USB PD standardizes on the USB-C connector, it provides a converged open standard that allows high-voltage charging not only for mobile phones, but also laptops and tablets. OEM manufacturers can still achieve product differentiation through the Vendor Defined Message (VDM) in the PD communication protocol stack. Qualcomm, Apple and Samsung have joined, so they are converging on the trend of USB PD.

However, OPPO, Xiaomi, and Vivo are still pushing their proprietary standards, and time will tell if they are also complied with USB-C/USB-PD compliance and adopt USB PD with VDM. ON Semiconductor is contributing to this trend towards USB PD 3.0 with PD Programmable Power Supply (PPS) products that are optimized for different power levels and features to serve the entire fast-charging spectrum mentioned earlier .

With the gradual maturity of the technology of chip manufacturers, the improvement of manufacturing capacity and the reduction of prices, etc., the door of GaN power devices to consumer users has been opened again. The demand for smart terminal equipment is the main factor for the popularization of GaN (gallium nitride) power devices.

At present, there are not a few mobile phones selling GaN (gallium nitride) high-power charging. GaN has better characteristics than traditional silicon (Si) semiconductor materials and has been used to manufacture transistors, amplifiers, diodes and other components, especially in power In the device field, GaN enables smaller size and higher efficiency chargers.

GaN has 3 times larger band gap than silicon, 10 times higher breakdown field strength, 3 times larger saturation electron migration velocity, and 2 times higher thermal conductivity. The advantage brought by these performance improvements is that GaN is more suitable for high-power and high-frequency power devices than silicon, while being smaller in size and higher in power density. GaN devices have extremely high switching speeds and small on-state resistance under the same wafer, enabling higher efficiency and faster charging at higher switching frequencies.

The introduction of GaN technology injects a catalyst into the high-power fast charging market, accelerates the update and iteration speed, and completely activates the consumer power supply market that has been silent for nearly ten years.

According to statistics, in the charger market dominated by e-commerce customers, the shipment of GaN power devices in 2019 will be about 3-4 million pieces. A 6-fold increase, with a total shipment of 15-20 million pieces, and the shipment of GaN devices is expected to reach 50 million pieces in 2021.

GaN fast charging can certainly reduce the volume. Lin Chengwen, business manager of Jianbo Microelectronics (Shenzhen) Co., Ltd. believes that the current size of the charger is not the determining factor for consumers to buy fast charging products, but the price is more concerned. Lin Chengwen said that GaN materials are not a necessary option in the field of high-power fast charging, and lower prices can truly open up the market structure. It is expected that the price of mainstream high-power fast charging will eventually be reduced to less than 100 yuan.

However, GaN power devices are expensive, and GaN FETs are the most expensive components in high-power fast-charging solutions, accounting for 15% to 25% of the cost. Lin Chengwen said that MOSFETs as GaN can improve the better energy efficiency and higher switching frequencies required by high power density chargers. As high-power chargers become the norm, we will see the price of GaN power devices drop. Currently, GaN is not expected to completely replace Si MOSFETs, as there are still low-cost cell phones and other products that require lower-cost box charger accessories. In addition, there are many other lower power applications that do not require the performance of GaN.

At present, there are three main suppliers of GaN power devices: Innosec, Nano Micro Semiconductor, and PI. With GaN fast charging gradually becoming the mainstream, PI took the lead in launching PowiGaN technology, and developed 5 series of chip products based on PowiGaN technology, including InnoSwitch3-CP, EP, Pro, MX and LYTSwitch-6, perfecting the power chip family.

Navitas' GaN power ICs are as favored by the market as PI. According to incomplete statistics, Navitas GaN Fast power ICs have been widely used in OPPO 50W biscuit GaN fast charging and RAVPOWER 65W 1A1C GaN fast charging. device, Xiaomi 65W USB PDGaN charger, SlimQ 65WGaN USB PD fast charger 1A1C, Anker PowerCore Fusion PD ultra-polar charger, RAVPower 45W GaN PD charger, Baseus 65WGaN charger, ROxANNE 66W GaN USB PD dual-port fast charger Wait. Among them, the 120W, 2C1A GaN (GaN) + silicon carbide (SiC) charger first launched by Baseus in July also uses the Nano-Micro NV6127 chip.

Innosec is the only domestic GaN-on-silicon manufacturer on the list. At present, there are two 8-inch silicon-based GaN chip R&D and production bases in Zhuhai and Suzhou, and the product line covers a full range of 40V-650V GaN chips. At present, Innosec INN650D02 is used in 65W fast charging products of Meizu, Lapo and Locke.

In addition to the above three suppliers, companies such as Xiaomi, China's top technology enterprise, Samsung, OPPO, and Apple all have accumulated experience in GaN technology and are bound to go further on this road. The GaN fast charging market capacity is expected to expand rapidly. Third-party power adapter manufacturers have entered the field, making this field a trend of competition. In the future, it will be an oligopoly, or a hundred flowers will flourish; whether it will be dominated by mobile phone manufacturers, or led by e-commerce and power adapter manufacturers, we will wait and see.

Disclaimer: This article is reproduced from "Xinwen No. 1". This article only represents the author's personal views, not the views of Saco Micro and the industry. It is only for reprinting and sharing, and supports the protection of intellectual property rights. Please indicate the original source and Author, if there is any infringement, please contact us to delete it.

Site Map | 萨科微 | 金航标 | Slkor | Kinghelm

RU | FR | DE | IT | ES | PT | JA | KO | AR | TR | TH | MS | VI | MG | FA | ZH-TW | HR | BG | SD| GD | SN | SM | PS | LB | KY | KU | HAW | CO | AM | UZ | TG | SU | ST | ML | KK | NY | ZU | YO | TE | TA | SO| PA| NE | MN | MI | LA | LO | KM | KN

| JW | IG | HMN | HA | EO | CEB | BS | BN | UR | HT | KA | EU | AZ | HY | YI |MK | IS | BE | CY | GA | SW | SV | AF | FA | TR | TH | MT | HU | GL | ET | NL | DA | CS | FI | EL | HI | NO | PL | RO | CA | TL | IW | LV | ID | LT | SR | SQ | SL | UK

Copyright ©2015-2025 Shenzhen Slkor Micro Semicon Co., Ltd