Strategy and Changes In August this year, ON Semiconductor's new CEO Hassan El-Khoury announced the company's new strategic direction, namely smart power and intelligent sensing. At the same time, the company name was changed from ON Semiconductor to onsemi, with all lowercase letters, in order to transform the traditional and formal company image into a new one that is friendly, innovative and grounded. The main color of the company's communication has also been changed from green to orange, symbolizing that the company will become more dynamic. El-Khoury is only 41 years old. He can be described as a young leader in the traditional semiconductor industry, a newcomer and a new look. These changes can be considered to complement each other.

New ON Semiconductor logo Source: ON Semiconductor

Considering that the semiconductor industry is currently in a super boom period and the supply exceeds demand, ON Semiconductor does not have to worry about short-term revenue decline, which not only greatly reduces the resistance for ON Semiconductor's strategic adjustment, but also because of sufficient funds in the capital market, Provide sufficient impetus for the company's transformation, such as the recent acquisition of silicon carbide substrate supplier GTAT (GT Advanced Technologies). Let's take a closer look at the financial performance of the first quarter after the announcement of the new ON Semiconductor strategy.

Financial Overview The company's revenue in the third quarter of 2021 was US$1.74 billion, an increase of 32% year-on-year and a quarter-on-quarter increase of 4%. Gross

margin surged 8% from the same period last year to 41.5%, which should be the company's first gross margin above 40% in a decade. Operating expenses for the quarter were $296 million. On the premise of increased revenue, operating expenses did not increase, but decreased by $18 million compared to the previous quarter. Fixed asset investment was also only $93 million in the quarter, or 5.4% of revenue. Combining several factors,

the company's operating profit margin reached 24.5% this quarter, compared with 19.6% in the previous quarter and 12% in the same period last year. Cash flow from operations has also grown significantly, accounting for 20% of revenue. The results not only exceeded the company's own expectations, but also exceeded analysts' previous judgments.

ON Semiconductor expects fourth-quarter revenue to be between $1.74 billion and $1.84 billion, with a gross profit margin of 42%-44%. While the company can't give a forecast for the first quarter of fiscal 2022, CFO Thad Trent believes revenue will be flat, without the usual 2%-3% seasonal downward revision. At the same time, the company will continue to withdraw from non-core businesses and implement the Fablite plan in accordance with the strategy announced on the investor day. In the next few years, ON Semiconductor will invest a relatively high proportion of fixed assets in the East Fishkill Fab (EFK) 12-inch wafer fab and silicon carbide production capacity, and continue to maintain the company's core competitiveness in the future.

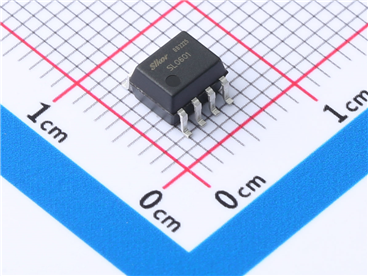

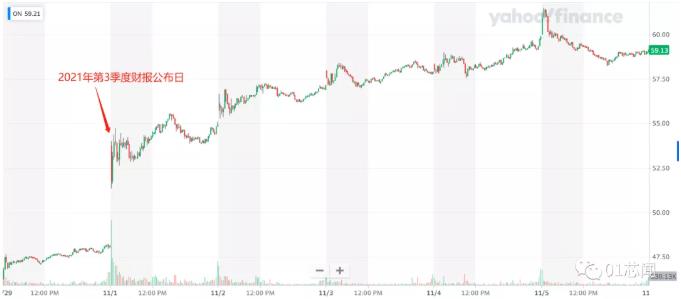

On the basis of the above-mentioned good news, the share price of Ansemi rose sharply on the day of the financial report, up 14% from the trading day of the previous quarter. And in the following days, it reached new highs repeatedly, and even stood at the price of 60 US dollars per share at one point, and the company's market value exceeded 25 billion US dollars.

ON Semiconductor's share price performance in the days before and after the announcement of Q3 2021  ; Source: Yahoo!Finance

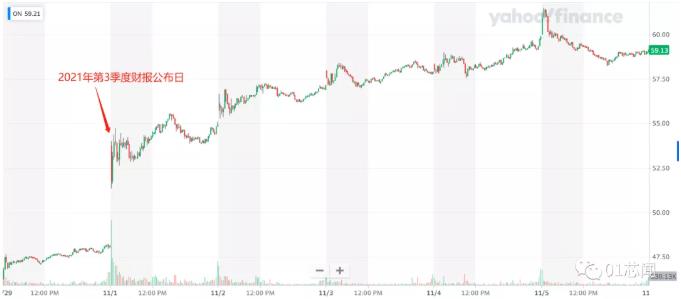

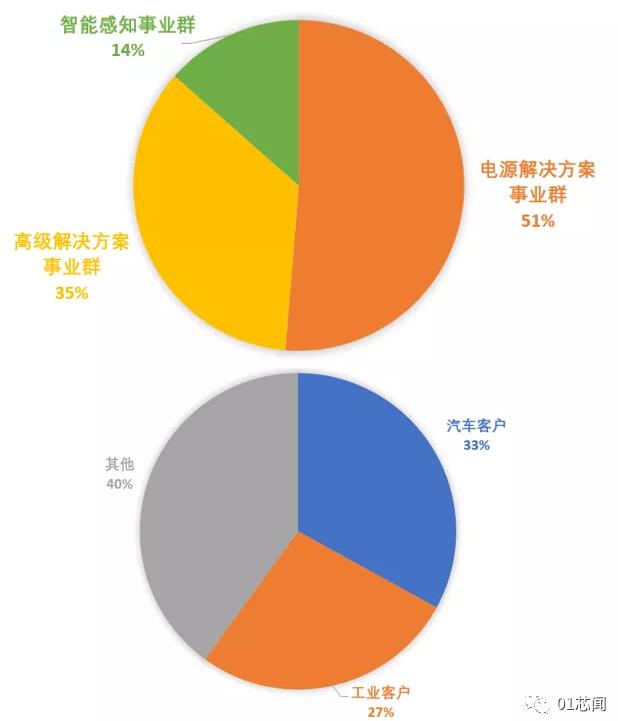

Financial report details According to ON Semiconductor's traditional division method, revenue can be divided according to business groups and customer industries, from which you can see the company strong products and major application markets.

Power Solutions Group (PSG) revenue for the third quarter was $892 million, an increase of 38% year-over-year. Advanced Solutions Group (ASG) revenue was $614 million, up 24% year over year. The Intelligent Sensing Group (ISG) revenue was US$237 million, a year-on-year increase of 35%. The three business groups accounted for 51.3%, 35.2% and 13.5% of the total revenue respectively.

Revenue by traditional method Source: ON Semiconductor, 01 core Smell finishing

At the same time, automotive and industrial customers contributed more revenue growth than other industry customers, increasing to 60% of the company's total revenue from 56% a year ago. Among them, automotive customers brought in US$576 million in revenue, accounting for 33%, an increase of 37% year-on-year, and a month-on-month increase of 4%; revenue from industrial customers was US$479 million, accounting for 27%, an increase of 48% year-on-year, month-on-month up 11%.

ON Semiconductor management stated in the earnings conference call that

the increase in the company's revenue and gross profit margin in the quarter was mainly due to improvements in operating efficiency, changes in product mix, and increases in selling prices.

/strong>.

First of all, the operational efficiency in the third quarter improved, and the shipment volume increased by 3% compared with the previous quarter. Even so, El-Khoury said that the production capacity still cannot meet all the needs of customers, and some customers can only guarantee the minimum quantity supply to avoid production line downtime. At the same time, new shipments in the quarter were mainly concentrated in high gross margin products.

Secondly, ON Semiconductor revealed in its investor day in August that the company will gradually withdraw from non-core businesses, and the affected revenue is expected to account for 10-15% of the total revenue. %. The average gross profit margin of these non-core businesses planned to exit is only 15%, which is much lower than the core businesses selected for strategic direction. In the past six months, ON Semiconductor has exited about $100 million in non-core businesses, 60% of which were completed in the just past 3rd quarter. The first two factors are added together and the other is subtracted, the product mix in the third quarter is skewed towards higher gross margin products, and the proportion of non-core businesses with low gross margins gradually decreases, so the average gross margin improves. The company expects the remaining non-core businesses to be phased out over the next two years.

Third, in terms of price, El-Khoury said that the quotation of core products will not be the same as before, and it must meet the customer's annual fixed cost reduction requirements. Instead, it works with customers to lock in prices through long-term supply contracts, guarantee capacity, and increase supply chain transparency and resilience. For example, he believes that for high-value products such as silicon carbide, companies must be able to price them sustainably, and the practice of proactively cutting prices to increase fab utilization during economic downturns will be a thing of the past.

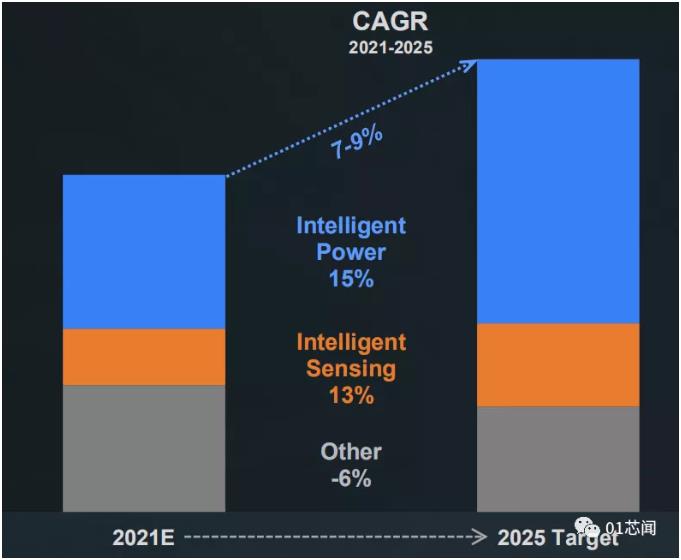

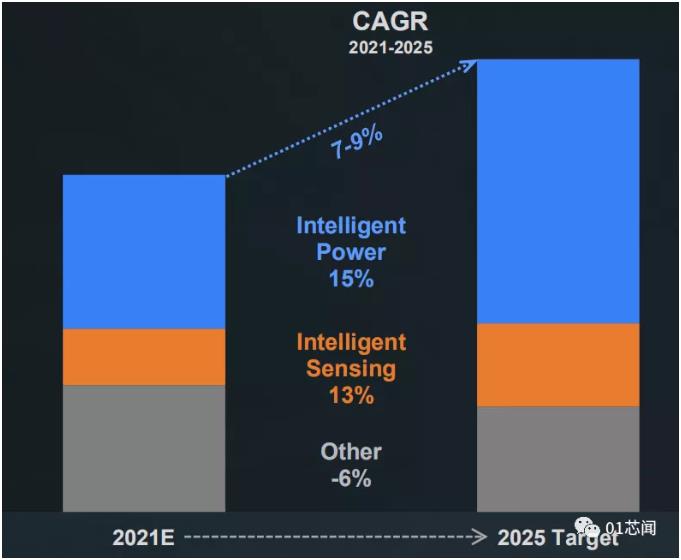

New strategic direction

This financial report also reflects ON Semiconductor's management's new strategic direction for the development of smart power and intellisense Happening. Among them, the revenue of intelligent power supply and intelligent perception has reached a record level, accounting for 62% of the total revenue. It can be seen that the two strategic development directions chosen by the company's management are indeed the company's revenue. main source. Both were up 3% and 8%, respectively, from the previous quarter.

ON Semiconductor's Development Expectations for Smart Power and IntelliSense Source: Anson Beauty

ON Semiconductor's Development Expectations for Smart Power and IntelliSense Source: Anson Beauty

Many key customers in smart power supply have signed or are in the process of signing long-term supply agreements with ON Semiconductor. El-Khoury revealed that by the end of the third quarter, ON Semiconductor had signed long-term supply contracts for power devices totaling US$2.5 billion with customers. In terms of products, $2 billion of this is for automotive and industrial silicon carbide devices. It can be seen that the production capacity of silicon carbide is the focus of customers scrambling to lock in. From a specific application perspective, two-thirds of these contracts are for electric vehicle powertrains, or inverters. Combining the two, the application of silicon carbide in electric vehicles is unstoppable. In addition, ON Semiconductor will supply these customers with long-term supply contracts as early as the end of this year, after which deliveries will roughly double each year. The company expects to generate $1 billion in 2023 revenue from silicon carbide devices.

In terms of intelligent perception, the revenue of automotive image sensors increased by 45% year-on-year and 10% month-on-month. A 75% increase in total design wins (Design-Win Funnel) over the same period last year. The situation of tight production capacity has eased slightly recently.

It is worth noting that the Power Solutions Business Group (PSG) is the core of the strategic direction of "smart power supply", while the Intelligent Sensing Business Group (ISG) is the absolute core of the other strategic direction "Intelligent Sensing" main force. In contrast, the role of the Advanced Solutions Group (ASG) is slightly awkward and may become the focus of future organizational restructuring.

Some findings

ON Semiconductor's acquisition of GTAT was completed on the same day as the third quarter earnings report, and its revenue will be consolidated into ON Semiconductor's fourth quarter in the quarterly earnings report. In the future, the company's silicon carbide substrates will be mainly outsourced to a hybrid mode of outsourcing and self-production. Interestingly, GTAT was acquired with only 119 employees worldwide, which is worth $4.5 million per GTAT employee, and it is not known how much additional income they could gain from this acquisition.

安森美在收购GTAT时对其的总结

安森美在收购GTAT时对其的总结

Source: ON Semiconductor

In the previous analysis article "From the Layout of the Power Two Giants, Looking at the Way to Evergreen Semiconductors", the author found that the WIFI and other technologies acquired by ON Semiconductor from Quantenna did not appear in the new strategic direction. This implicitly fits with a recent Bloomberg report that ON Semiconductor is looking to sell the asset for about the same price it bought in 2019 ($1 billion) and is now looking for potential buyers. Considering the depreciation of the U.S. dollar in 2019, the actual acquisition didn't do the company any financial favors. The buy and sell of the two companies, GTAT and Quantenna, shows ON Semiconductor's management's insistence on the new strategic direction. It is worth waiting for the performance of ON Semiconductor in the last quarter of 2021. What if it hits a new high again?

Disclaimer: This article is reproduced from "Semiconductor Industry Observation". This article only represents the author's personal opinion, not the opinion of Sacco Micro and the industry. It is only for reprinting and sharing, and supports the protection of intellectual property rights. Please indicate the original source and author for reprinting. , if there is any infringement, please contact us to delete it.

New ON Semiconductor logo Source: ON Semiconductor

New ON Semiconductor logo Source: ON Semiconductor  ON Semiconductor's share price performance in the days before and after the announcement of Q3 2021  ; Source: Yahoo!Finance

ON Semiconductor's share price performance in the days before and after the announcement of Q3 2021  ; Source: Yahoo!Finance  Revenue by traditional method Source: ON Semiconductor, 01 core Smell finishing

Revenue by traditional method Source: ON Semiconductor, 01 core Smell finishing  ON Semiconductor's Development Expectations for Smart Power and IntelliSense Source: Anson Beauty

ON Semiconductor's Development Expectations for Smart Power and IntelliSense Source: Anson Beauty  安森美在收购GTAT时对其的总结

安森美在收购GTAT时对其的总结